- Статьи

- Economy

- They don't know prices: Russians' inflation expectations prevent the Central Bank from actively reducing its key

They don't know prices: Russians' inflation expectations prevent the Central Bank from actively reducing its key

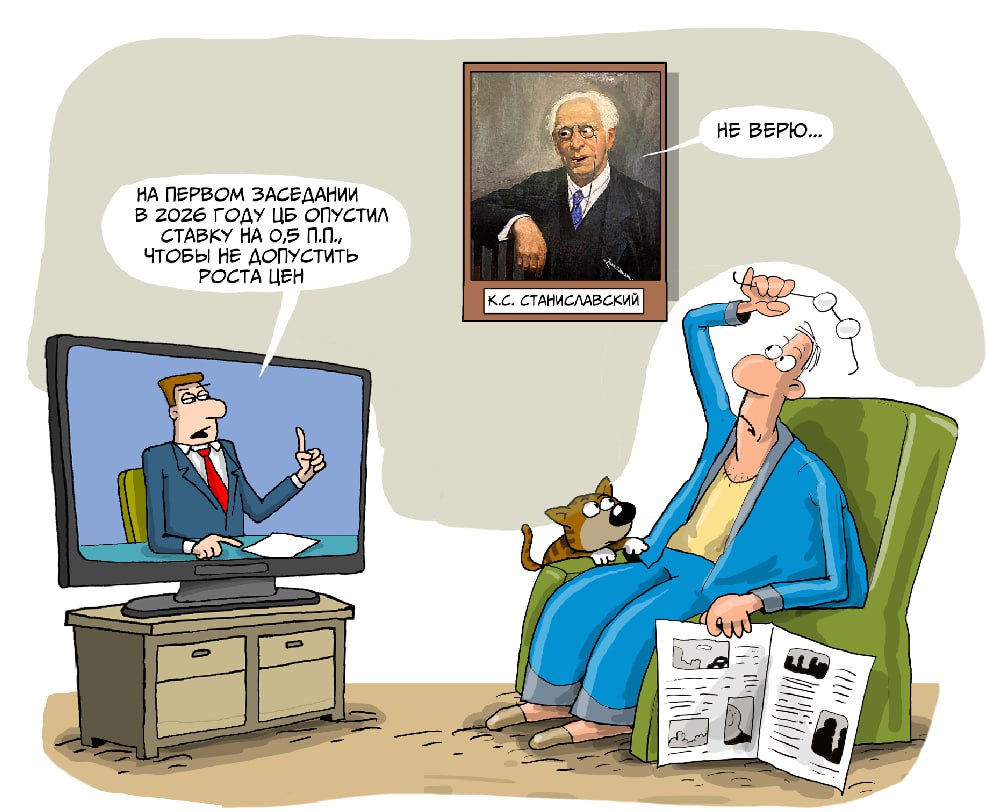

Inflated inflation expectations of the population do not allow the Central Bank to reduce the key rate faster, experts interviewed by Izvestia said. At the first meeting in 2026, the regulator lowered it by 0.5 percentage points, to 15.5%. The neat move is due to the fact that Russians still expect prices to rise at 13.7%, although inflation has slowed to about 6% by the end of 2025. This attitude encourages people to spend more money and buy goods for future use before they become more expensive, which in itself puts pressure on prices. Inflation expectations are not decreasing, largely because the rise in prices of food products is noticeably ahead of official figures. When the Central Bank will be able to reduce the rate more actively — in the Izvestia article.

How do people's expectations affect prices and rates

High inflation expectations will not allow the Central Bank to actively reduce its key rate for a long time, experts interviewed by Izvestia note. The Bank of Russia has repeatedly stressed that, all other things being equal, the regulator will soften policy more cautiously if the population and business expect a more active price acceleration.

Even if inflation is close to the 4% target, but the population's expectations for price increases remain high, there is a high risk that the indicator will not stay at this level. This was stated by the head of the Central Bank, Elvira Nabiullina, answering a question from Izvestia at a press conference following the meeting on the rate. According to her, this situation limits the space for reducing the key.

In January 2026, Russians' inflation expectations for this year remained at 13.7% and remained the highest since February 2025, according to monitoring data from the Central Bank. This happened despite a noticeable slowdown in price growth last year, from 9.5% to 5.6%. However, the population continues to focus not on statistics, but on their own feelings and is waiting for a new round of growth.

People's expectations of inflation depend on what rate they consider sufficient for savings and how much money they will eventually spend on savings, as Alexey Zabotkin, deputy chairman of the Central Bank, pointed out earlier. In fact, it is expectations that determine the real rigidity of monetary policy at the same key.

If the Central Bank's rate turns out to be below the expected inflation rate, it seems more profitable for people to spend money rather than save it, explained Olga Belenkaya, head of the Macroeconomic analysis department at Finam. This increases demand in the economy and, together with high business price expectations, facilitates the transfer of increased costs to prices, thereby accelerating inflation.

"In such an environment, an early and sharp rate cut can in itself accelerate inflation," said Vladimir Chernov, analyst at Freedom Finance Global.

When people expect prices to rise by about 14%, they begin to behave accordingly: they accelerate purchases, demand higher salaries, and include price increases in their plans in advance, said Sergey Grishunin, managing director of the NRA rating service. This is already putting a lot of pressure on prices.

Eventually, expectations turn into reality — inflation is accelerating, which is why people believe less and less in price stabilization and expect them to accelerate even more in the future. This process is called an "inflationary spiral."

Why Russians expect a strong price increase

In their estimates, consumers rely primarily on price increases in their personal shopping cart, rather than on official figures, explained Olga Belenkaya from Finam. The rise in price of so-called marker goods, such as food, gasoline, medicines, and housing and communal services, is especially noticeable. There are also very volatile items, such as cucumbers that have become a meme, and those goods and services that rise in price faster than general inflation, such as utility tariffs.

Inflation expectations in Russia are formed retroactively — people simply transfer past experiences into the future, said Sergey Grishunin from the NRA. If they saw a sharp jump in prices in 2024, they automatically expect a similar picture in 2026.

The rise in food prices is particularly well remembered: potatoes increased in price by 80-90%, eggs — by about 50%, butter — by 40%. In winter, cucumbers and tomatoes traditionally become more expensive at times, which increases the feeling of the so-called inflationary storm. And since products are bought every day, it is by them that people judge the overall price increase.

According to the Central Bank, the inflation felt by the population during the year was two to four times higher than the official statistics, said Vladimir Chernov, analyst at Freedom Finance Global. This experience is consolidated on a psychological level and continues to influence expectations.

How much will prices rise by the end of 2026

— The fears of the population are absolutely understandable, but the expectations of a price increase of about 14% in 2026 look too high, — said Vladimir Chernov.

The Central Bank predicts a return of inflation to the target of 4-4.5% this year, however, many families feel a stronger increase in prices, said Sergey Grishunin. This is especially noticeable for households with low incomes, who spend about a third of their budget on groceries. The gap between food inflation at the level of 12-15% and the general price increase of 8-9% creates the feeling that statistics underestimate the real level.

Expectations will definitely begin to decline when inflation remains close to the 4% target for a long time, Elvira Nabiullina stressed, answering a question from Izvestia at a press conference following a key rate meeting. At the same time, this process will be slower than before, because inflation has been high for too long.

— The main thing is the actual slowdown in inflation, especially food inflation. As our citizens look to the past, they need to be given a new experience: stable or even declining prices in stores for several months in a row. Only then will expectations begin to adjust," Sergey Grishunin emphasized.

The Central Bank is striving to bring inflation back to the target level and keep it there long enough to restore public confidence, Olga Belenkaya explained. With anchored inflation expectations, short-term price spikes caused by one-time factors cease to affect consumer behavior, which will allow the regulator to lower the rate faster.

In the long term, a reduction in the key rate is inevitable, concluded Mikhail Kostromin, co-founder of Activo. The key question is how fast this will happen and what will be the inflation rate.

Переведено сервисом «Яндекс Переводчик»