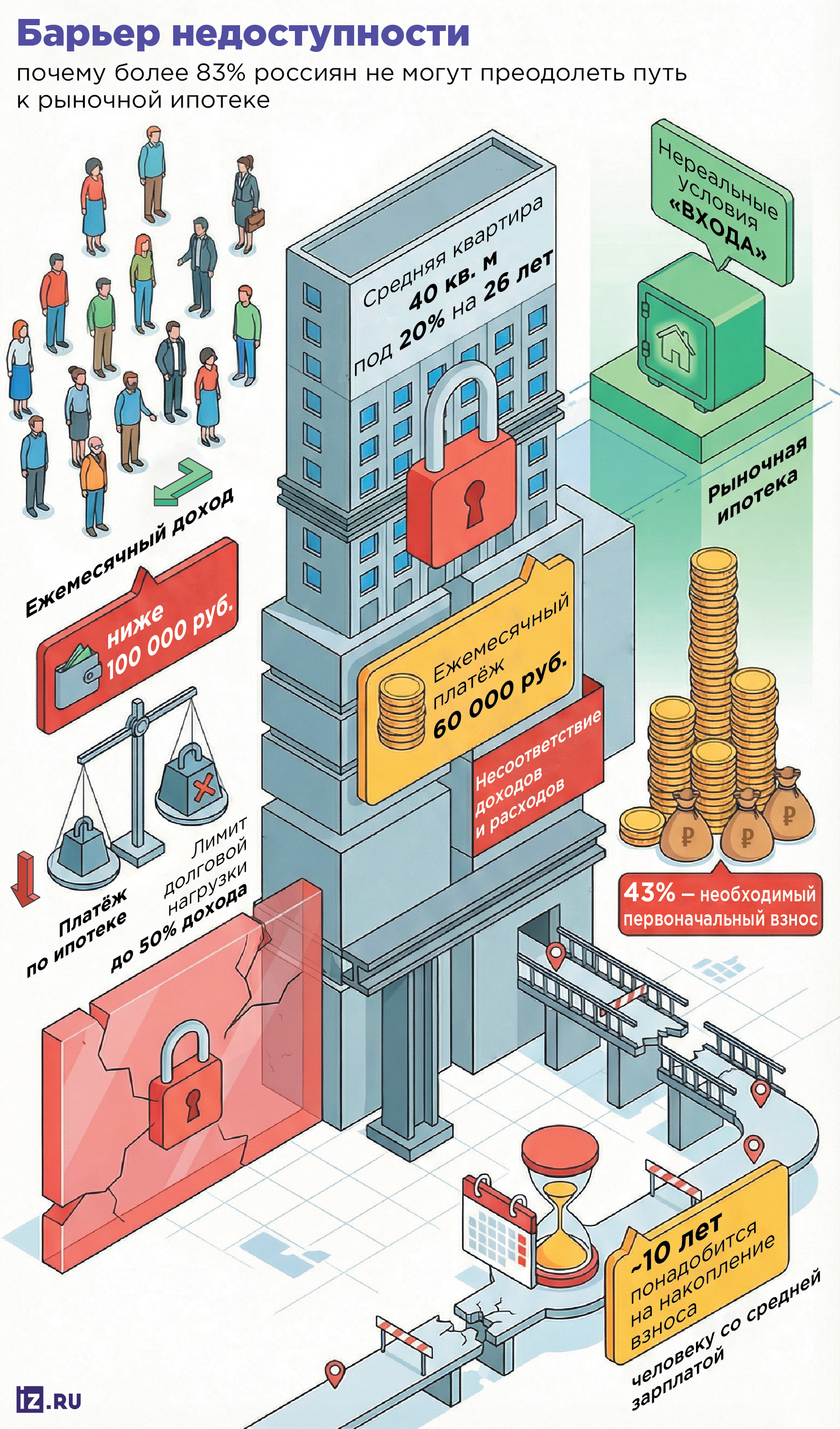

Playing for a room: a market mortgage is not available for 83% of Russians

A market mortgage is not available for 83% of Russians. As Izvestia found out, this proportion of citizens have incomes below 100 thousand rubles. And we should have 120 thousand. After all, to get approval for an application, you need to send no more than half of your income to repay the debt. At the same time, the mortgage is for a typical apartment of 40 sq. m. m at the current rates and terms will cost about 60 thousand rubles per month. To pass through bank filters, a borrower with a salary of about a hundred will need a down payment of 43% of the cost of housing, but it is possible to accumulate it only in 10 years. Whether mortgages will become more affordable by the end of the year is in the Izvestia article.

How affordable is a mortgage in Russia

A market mortgage for ready-made housing is available to less than one in six Russians, Izvestia estimates. Even a potential reduction in the key rate from 16% to 12% by the end of the year will not change the situation much.

The average salary in the Russian Federation in 2025 was 98.2 thousand rubles, while only 16.7% of Russians have incomes above 100 thousand, according to Rosstat data. 21.6% of citizens had salaries in the range of 60-100 thousand rubles, and 14.9% had salaries at the level of 45-60 thousand rubles. About half of Russians (47%) receive less than 45 thousand rubles.

Currently, banks comply with the Central Bank's limits on granting loans to borrowers with high debt loads. In practice, strict restrictions are not applied only to those clients who spend no more than half of their income on loan repayment. Banks cannot approve mortgages with a low down payment either.

The restrictions apply to both finished and under construction housing. Because of them, some citizens face refusals - the share of rejected mortgage applications has reached 65%. In order to be most likely to receive approval, it is advisable for a borrower to spend no more than half of his income on a mortgage and pay an initial payment above 20%.

The average cost of 1 square meter of ready-made housing, which is bought using a market mortgage, according to the Central Bank, is now about 130 thousand rubles. According to Izvestia's calculations, the average market mortgage rate in the top 10 banks is 19.8%.

For calculations, let's take a typical "eurodvushka" with an area of 40 square meters, its cost will be 5.2 million rubles. The monthly payment for such an apartment, even with a down payment of 30% and a maximum term of 30 years, will be about 60 thousand rubles.

Even a borrower with an income of 100,000 rubles is highly likely not to receive approval when applying for such a housing loan, and 83% of Russians have a salary below this level.

What should be the initial mortgage payment?

To meet the 50% debt burden limit, a borrower with a salary of about 100,000 rubles needs an initial payment of about 43% of the cost of an apartment — over 2.2 million rubles, Izvestia calculated. Only then will the monthly payment drop below 50 thousand rubles.

The initial payment on new loans often reaches half of the price of the entire apartment, confirmed Vitaliy Kostyukevich, director of Absolut Bank's retail products department. In Gazprombank, the figure is 45-55%, and in Dom.rf Bank it is about 38%.

To accumulate the necessary amount with a salary of 100 thousand rubles, you need to save at least 20% of your income for 9.5 years, Izvestia calculated. However, according to surveys, only 7% of Russians leave more than 20% of their income for these purposes, and almost three quarters — only 5-10%. For citizens with incomes up to 45 thousand rubles, the initial payment will amount to about 3.4 million rubles, or 65% of the cost of an apartment, and you will have to save for it for more than a decade, even deferring half of your salary.

Saving up for an initial payment of 20% is theoretically possible, but in practice it requires strong discipline, explained Igor Rastorguev, a leading analyst at AMarkets. In 10 years, hundreds of life situations can occur that require money. Therefore, many borrowers have to rely on the use of maternity capital and the help of relatives.

Will lowering the key rate improve the situation

The latest medium-term forecast of the Central Bank of the Russian Federation assumes a decrease in the key rate to 12% by the end of 2026. This could lower mortgage market rates below 16% by early 2027.

But even with such an annual percentage, the monthly payment for the average "secondary" will be about 52 thousand rubles. To meet the debt load limits, a borrower with a salary of about 100 thousand rubles will need an initial payment of about 33%, which will take about seven years to save, setting aside 20% of income.

For people with lower incomes, a market mortgage becomes virtually inaccessible without a significant increase in the initial payment, attracting a second source of income, or switching to preferential programs, explained Maxim Lazovsky, owner of the Lazovsky House construction company.

Is it easy to get a family mortgage

Family mortgages at 6% have become the backbone of the market — in December 2025, it accounted for 75% of loans, said Igor Rastorguev from AMarkets.

The program is targeted — it is available only to families with children under six years old or with a disabled child, explained Vadim Butin, head of the mortgage lending department at Glavstroy-Real Estate. Childless families, couples with children over the age of six, and single citizens cannot apply for it. In addition, the program is designed only for the primary housing market.

Average price of 1 sq.m. m in a new building, apartments in which they take with preferential loans, according to the Central Bank, are about 208 thousand rubles. The apartment is 40 sq. m. An apartment costs 8.3 million rubles, but the soft loan limit for most regions is 6 million rubles, which corresponds to an apartment with an area of only about 29 square meters. m. Let's take it as the basis for calculations.

With an initial payment of 30% and a term of 30 years, the monthly payment for such a loan will be about 25 thousand rubles. A borrower with an income of 50 thousand rubles is highly likely to be able to get approval.

According to data at the beginning of 2025, about 47% of Russians had salaries below 45 thousand rubles. In order to "fit" into the debt load limits, when applying for a mortgage, they will have to contribute about 38% of the cost of the apartment — about 2.3 million rubles. If you save 20% of your income, it will take at least 21 years to accumulate.

In addition, the authorities are discussing the possibility of raising the rate under this state program to 10% for families with one child under the age of six. Then the payment will increase to 35 thousand rubles, which will make the mortgage inaccessible for incomes below 60 thousand rubles — almost two thirds of such people in the Russian Federation.

How to circumvent the Central Bank's debt burden requirements

The chances of approving a loan with a debt burden index of more than 50% exist, but they are greatly decreasing, explained Yuri Belikov, managing director of the Expert RA rating agency. Theoretically, approval is possible in a small bank that is ready to increase its customer base to the detriment of itself, but there are no guarantees — the borrower may encounter refusals everywhere.

For a bank, a client with a personal income tax above 50% is considered risky, because he is sensitive to any changes in income or expenses, said Vadim Butin from Glavstroy-Real Estate. At the age of 20-30, the probability of financial failures for such borrowers is higher, so banks try to minimize such transactions.

In principle, it is imprudent to seek approval of a loan with a load above this level, Yuri Belikov emphasized. The borrower believes that he has "calculated everything," but inflation or unpredictable expenses can lead to a loss of solvency. In this case, a person risks losing their home.

Attracting co-borrowers can increase the chances of mortgage approval, Igor Rastorguev explained. For example, starting from February 1, when applying for a family mortgage, spouses must become spouses — the bank summarizes their salaries and loan obligations. This increases the chances of approval, provided that both have sufficient and proven income.

However, such a scheme implies the joint responsibility of all participants, Maxim Lazovsky noted. Any deterioration in the financial situation of the family can lead to a delay. Such risks include even a woman going on maternity leave, accompanied by a decrease in her income.

In Gazprombank, co-borrowers participate in 40% of cases when applying for a mortgage, the organization said. Changes to the family mortgage in 2026 will increase the share of such loans, as the state program now requires it.

The number of transactions with co-borrowers will increase due to the new conditions of the family mortgage, confirmed Vitaly Kostyukevich from Absolut Bank. At high rates, the state program will remain important for families with children — couples have a higher total income, as well as the chances of approval of the application, concluded Natalia Milchakova, a leading analyst at Freedom Finance Global.

Переведено сервисом «Яндекс Переводчик»