- Статьи

- Economy

- Preferential reef: 3 million families will lose access to family mortgages due to rising interest rates

Preferential reef: 3 million families will lose access to family mortgages due to rising interest rates

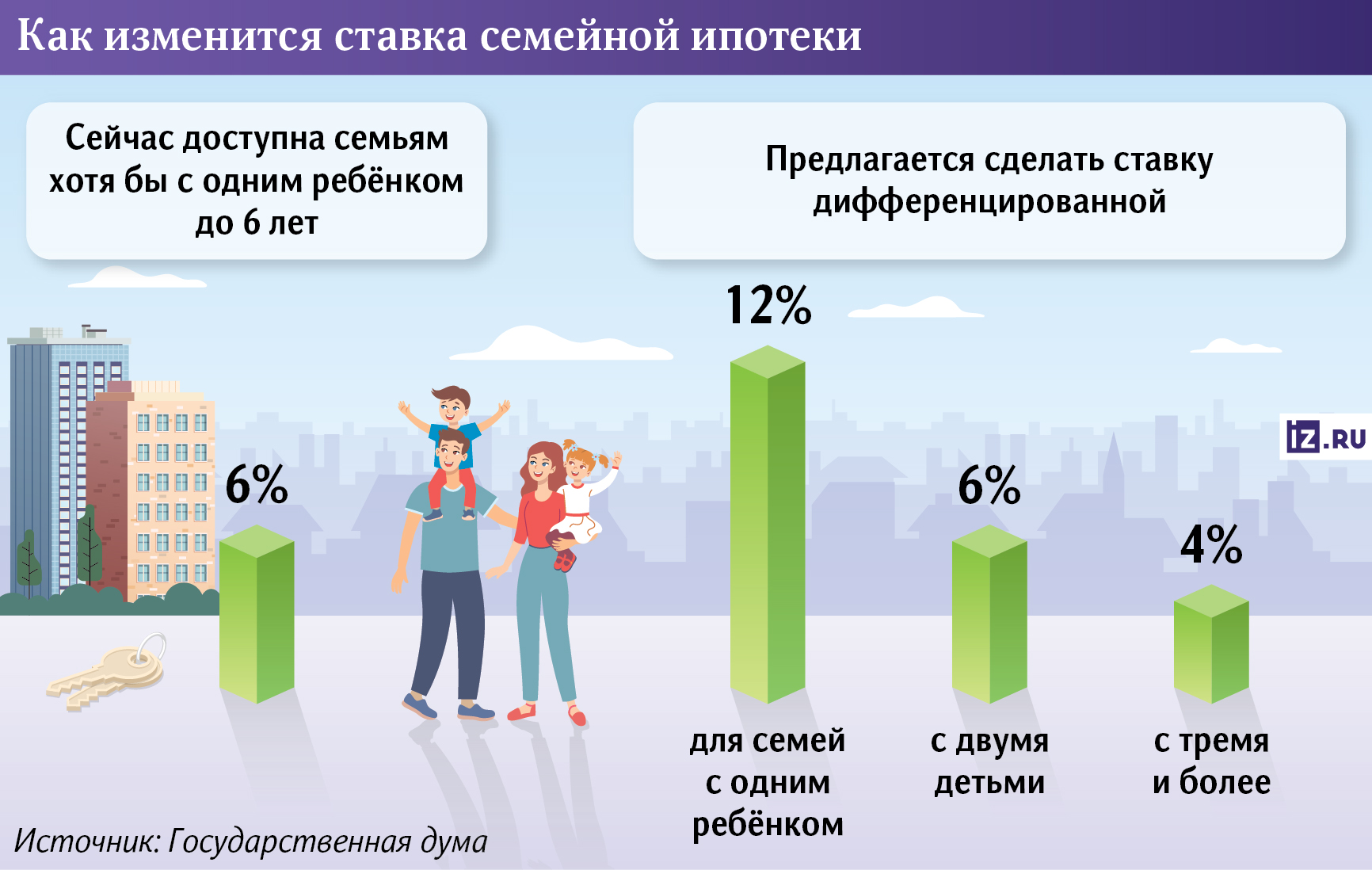

Millions of Russians will lose access to family mortgages, analysts told Izvestia. This will happen if the authorities raise the rates on it from 6% to 12% for married couples with one child — there are more than half of them in the country. With this development, preferential housing loans will become unaffordable for almost 3 million Russian families, experts say. The monthly payment for such loans will increase 1.5 times, and the overpayment — 2.5 times. The question of whether the market will face excessive demand for a family mortgage before changing the conditions for obtaining it is in the Izvestia article.

How much will family mortgage issuance decrease

Russians in need of better housing conditions will lose access to a family mortgage due to an increase in the preferential rate. This was reported to Izvestia by experts and the Domclick service. About 2.7 million families with one child will no longer be able to get a loan at 6% per annum, and they will have to buy it at a significantly higher percentage, experts interviewed by Izvestia noted.

The family mortgage was launched in 2018. In 2024, it was extended for another six years, changing the conditions. The program's rate is 6%, and the benefit is available to families with children under six, with children with disabilities or from small towns of up to 50,000 people, as well as families with two or more children in regions with low construction.

The Ministry of Finance is discussing changing the terms of the family mortgage. They want to raise the rate to 10-12% for families with one child, keep it at 6% for families with two children, and reduce it to 4% for families with three or more children. This was announced by Anatoly Aksakov, head of the State Duma Committee on the Financial Market. He noted that the deputies continue to discuss the size of the rate for large families. The changes may start working as early as 2026.

Izvestia asked the Ministry of Finance: is the introduction of a differentiated rate included in the calculation of budget expenditures on family mortgages in 2026-2028?

In Russia, 55% of families have one child, 33% have two, and 12% have three or more children, according to a Domclick study. There are 11.6 million families with children under the age of seven in the country, of which 4 million have an only child. Of these, 1.2 million families have already used the program.

It turns out that changing the conditions of a family mortgage may deprive about 2.8 million Russian families of access to a preferential rate of 6%. A similar assessment was given by Freedom Finance Global and Ingo Bank.

With an increase in the rate to 12%, the debt burden for many borrowers will exceed the threshold of 50-80% allowed by banks, explained Oleg Abelev, head of the analytical department at the Rikom-Trust investment company. According to his estimates, about a fifth of families who would be approved for a loan at 6% will be refused at the new rate.

"With an increase in the preferential rate to 12%, the median monthly payment on a family mortgage for families with one child will increase by 38% to 43.5 thousand rubles per month, which may lead to the cancellation of the program by a significant proportion of potential borrowers with low incomes," predicted Vasily Kutyin, Director of Analytics at Ingo Bank.

The overpayment on a family mortgage at 12% in the amount of 10 million rubles and for an average term of 28 years will be 2.5 times higher than the loan amount. At the same time, at the current rate of 6%, it would only be twofold, the expert added.

Eventually, housing affordability may decrease significantly. It is government support that remains the main driver of the market — according to the United Credit Bureau (OKB), preferential mortgages account for more than 70% of the total volume of housing loans.And most of the loans come from family mortgages.

According to Natalia Melnikova, a leading analyst at Freedom Finance Global, few people will be able to use the preferential rate at 4% per annum — only 0.5–1.2% of the total number of families meeting the program criteria.

What will be the demand for family mortgages by the end of the year

Traditionally, before changing the terms of government programs, there is a surge in demand, so we can expect an increase in family mortgage payments by 20-30% in the last months of the previous rate, says Ekaterina Shchurikhina, Director of Banking Ratings at Expert RA. As early as the fourth quarter of 2025, disbursements under the program may increase by a third, Natalia Milchakova from Freedom Finance Global said.

In October, there has already been an increase in demand relative to the September values, said Denis Zhalnin, CEO of the development company People. It amounted to 20-25%, while there was increased interest both in family mortgages, after the announcement of its changes on February 1, and in market programs, he said.

Barriers to the surge in demand will be the persistence of high prices for new buildings, increased inflationary pressure in the consumer market and a reduction in savings among the majority of the population, said Vasily Kutyin from Ingo Bank.

— Until December, demand will continue to grow actively, and in January, a gradual decrease will begin, both due to seasonal factors and due to saturation in previous periods. In 2026, we forecast a 15-20% decrease in mortgage loans in the primary market," Denis Zhalnin summed up.

The proposed changes in the family mortgage rate can really support the birth rate in the country, Denis Zhalnin concluded. However, you need to understand that the main problem for young families is starting housing, for which you need to have money for the down payment. After the changes, many Russians may face two problems at once: the loss of the opportunity to take out a cheaper mortgage and the inability to save up for a down payment on a housing loan due to the increasingly expensive rent.

At the same time, the changes are designed to make preferential loans more targeted so that government support reaches exactly those citizens who need it most, said Igor Dodonov, an analyst at Finam Financial Group. For example, starting from February 1, 2026, both parents will be registered as co—borrowers on a family mortgage. This will eliminate the scheme when families took out two preferential loans at once instead of the required one.

Переведено сервисом «Яндекс Переводчик»