Not everyone is at home: the share of mortgage refusals has exceeded 60%

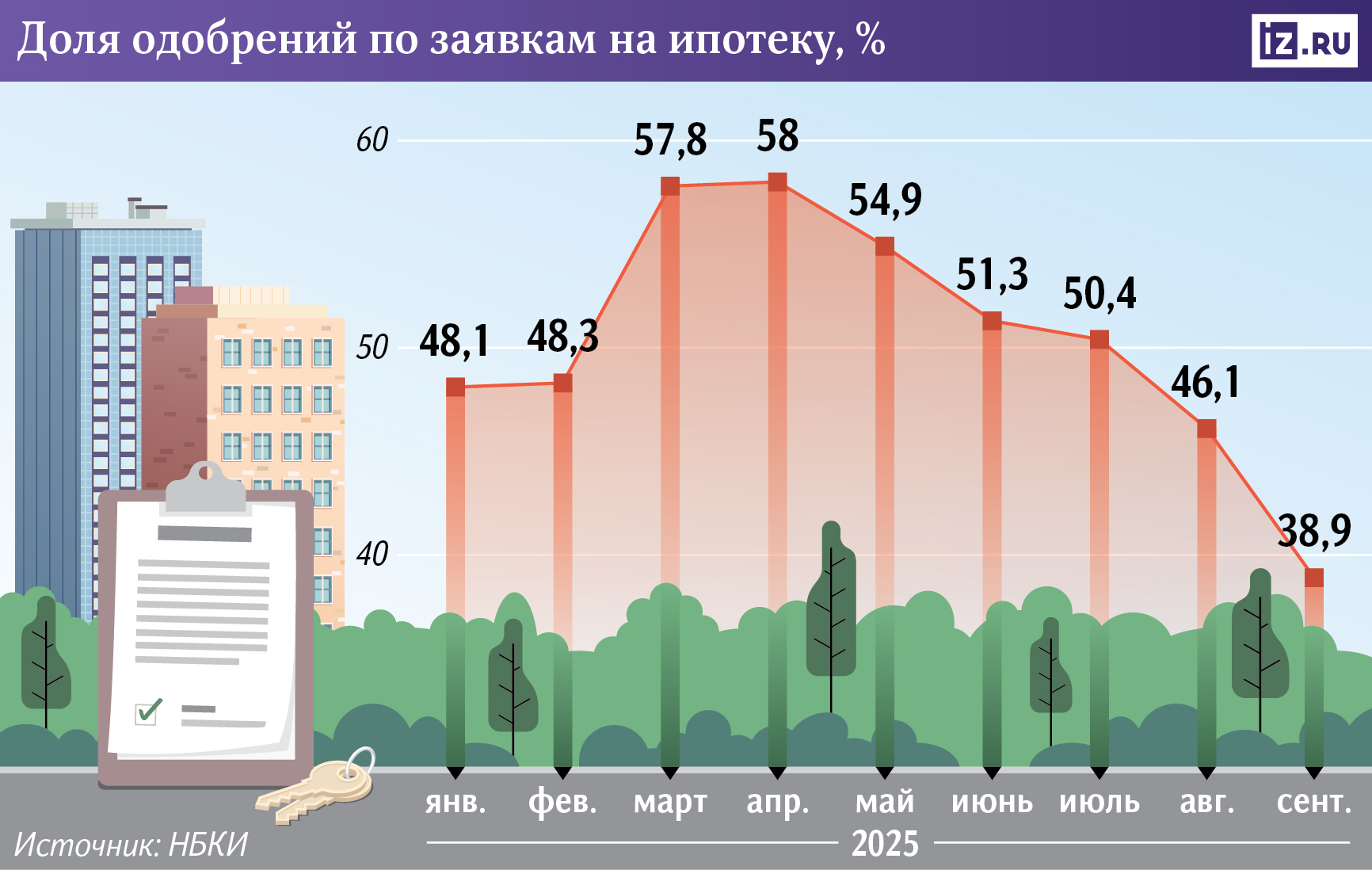

By the end of September, banks refused to issue mortgages in 60% of cases, according to the NBKI data, which was studied by Izvestia. Russians managed to get a housing loan for less than half of the applications, which is the minimum in recent years. Financial institutions are very sensitive to risks due to the Central Bank's restrictions on issuing loans to borrowers with high debt loads. In addition, they often turn down those who make the minimum down payment for a mortgage. How to increase the chances of approval of an application for a housing loan — in the material of Izvestia.

Why did the bank refuse the mortgage

The share of mortgage refusals for the first time exceeded 60%, according to data from the National Bureau of Credit Histories (NBKI), which Izvestia has. Currently, only 39% of housing loan applications are approved, and the figure has decreased by almost 10% since the beginning of the year. This is due to the tightening of banks' risk policies, including due to Central Bank regulation.

The increase in the number of mortgage refusals is due to the introduction of special restrictions by the Central Bank on the share of borrowers with a high debt burden among clients of financial organizations from July 1, 2025, said Dmitry Gritskevich, Head of Banking and Financial Market Analysis at PSB. Because of them, it is unprofitable for credit institutions to issue riskier loans to those who spend more than half of their income on debts and at the same time pay a small down payment.

This approach is working — according to the Central Bank, in the third quarter of 2025, the share of risky mortgages with a borrower's debt burden above 80% decreased to 6% against 47% a year earlier, and with a down payment below 20% - to 3% against 51% in 2023, said Director of Markets of Russia and the CIS fam Properties by Valery Tumin. According to him, the system is aimed at protecting citizens from excessive debts.

The reduction in the key rate to 16.5% and cheaper loans have not yet brought most reliable borrowers back to the market, as rates remain high, said Alexey Volkov, marketing Director of the National Bureau of Credit Histories (NBCI). At the same time, banks that are limited in providing loans to customers with high debt loads are in no hurry to increase their risks, trying to maintain the quality of their loan portfolios.

The situation is also affected by the increase in loan delinquencies, the head of the Bank's expert analytics department added.<url> Inna Soldatenkova. Because of this, financial institutions are forced to maintain strict requirements for borrowers, because additional reserves have to be allocated for distressed assets — this reduces their possible profits.

The decrease in the share of approved applications in September reflects the growing popularity of mortgage market programs, said Ekaterina Shchurikhina, Director of Bank Ratings at Expert RA agency. According to DOM.In the Russian Federation, the main increase occurred precisely on market programs — their volume reached 90 billion rubles (+18%), which is associated with the beginning of a reduction in rates.

The cost of mortgages on second homes is still high, said Vitaly Kostyukevich, Director of Absolut Bank's Retail Products department. According to Izvestia, the rates can reach up to 24%. At this rate, a loan of 10 million rubles for 25 years with a down payment of 20% will cost more than 150 thousand rubles per month. Because of this, it is difficult for many borrowers to meet the requirements for the debt burden, and banks refuse them.

How to increase the chances of mortgage approval

Financial institutions still prefer borrowers with a good history, low debt burden and high credit rating, said Inna Soldatenkova from <url>. Due to high housing prices, clients are also expected to earn a fairly high income.

"The higher the initial payment is made by the borrower, the lower the loan amount will be and, as a result, the monthly payment will be lower, which means the required income level for approval," she explained.

Insufficient down payment is a very common reason for mortgage refusals, concluded Valery Tumin, Director of Russian and CIS Markets at fam Properties. If it is less than 20%, only 3% of borrowers receive approval, so it is important to maximize it.

In order to increase the chances of obtaining a mortgage, it is important to reduce the debt burden, said the representative of the PSB. To do this, it is worth paying off existing loans. Do not forget about plastic cards — when calculating the debt burden, financial organizations take into account all existing borrowed funds available to the client, Absolut Bank clarified.

— It is worth applying to several banks at once, since everyone has different criteria, — Valery Tumin recommended.

In addition, it is possible to attract a co-borrower, said Vitaly Kostyukevich from Absolut Bank. This is a person who, together with the main borrower, assumes responsibility for paying off the loan. The bank takes into account the incomes of both when calculating solvency, so this way you can get approval for a large amount or increase the chances of mortgage approval if one person's income is insufficient.

You can reduce the monthly payment by applying for a mortgage for a longer period, Inna Soldatenkova added. However, there is a limitation here — the age of the borrower or co-borrower: the higher it is, the shorter the period for which the bank is ready to issue a loan. In addition, at current rates, it makes sense to postpone the purchase of a home unless it is urgently needed. As the key interest rate decreases, mortgages will become cheaper, and a lower income level will be required to obtain them.

Borrowers should not rush to take on an excessive debt burden, Vitaly Kostyukevich added. Many are counting on refinancing when rates drop and such an opportunity really appears. However, it is difficult to predict when exactly this will happen — in a few months or a year. During this time, you will have to fulfill your loan obligations properly. If there are delays, the bank can easily refuse to refinance.

Experts expect an increase in mortgage approvals in the second half of 2026, when the key rate, according to the forecast of the Central Bank, will decrease to 13-14%, and mortgage rates to 14-15%. This may lead to an increase in the volume of housing loans to 6 trillion rubles by the end of 2026.

Переведено сервисом «Яндекс Переводчик»