What should an investor keep an eye on this week

The reduction of the key rate to 16% (by only 0.5 percentage points) last week will not lead to an increase in purchases on the stock market, therefore, an increase in the value of securities should not be expected, Finam said. In the last full working week before the New Year, the background for stocks will be mostly neutral. However, the value of individual assets may change due to corporate events.

The Central Bank's decision will largely determine investor sentiment until the end of the year. Nevertheless, significant progress in the negotiations on Ukraine may lead to an increase in the stock market by 10-15%, said Ilya Kupreev, portfolio manager of the First Management Company.

Monday, December 22, will be the last day of the purchase of shares of the Polyus gold mining company and Avangard Bank with the right to dividends for the first nine months of 2025, Finam said.

On December 23, Rosneft and Ozon Pharmaceuticals will make decisions on the payment of dividends, BCS Mir Invest reported. December 23 is also the last day for the purchase of shares of the mineral fertilizer producer Akron with dividends, according to the Digital Broker.

Wednesday is the last day of the purchase of shares of the financial holding company "EsEfAi" to receive dividends, Finama and Digit Broker reported. Tatneft will make a decision on dividends on the same day. Also on December 24, the Bank of Russia will publish a review on the development of the banking sector for November.

On December 25, EuroTrans and the IT holding T-Technologies will hold extraordinary shareholder meetings on dividends, BCS Mir Invest reported.

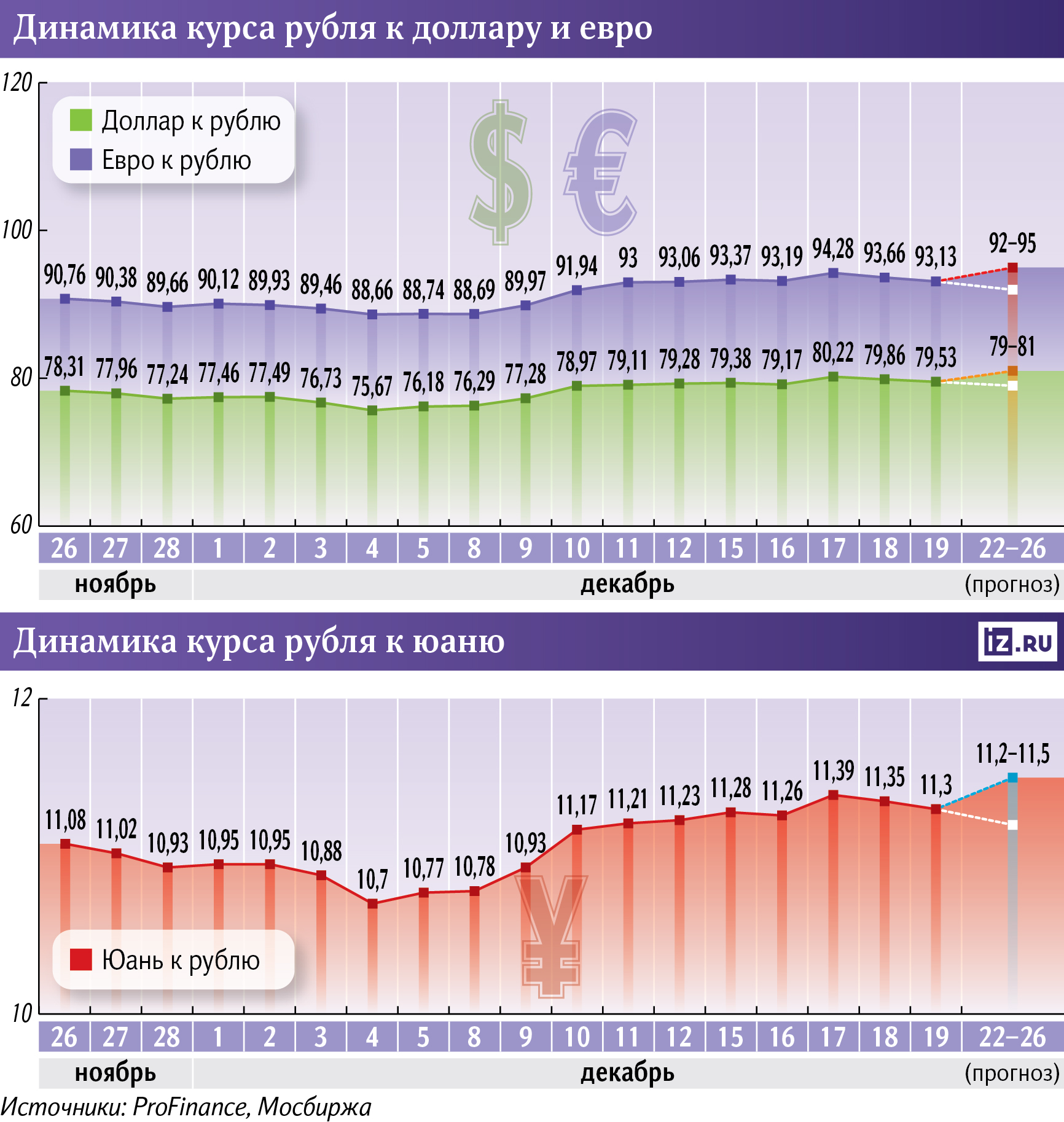

The RGBI government bond index may exceed 120 points in the coming weeks, the investment company "Digital Broker" predicts. According to analysts, the dollar may trade at 79-81 rubles, the euro at 92-95 rubles, and the yuan at 11.2–11.5 rubles. In the stock market, experts expect the upward movement to continue: the Moscow Exchange index is able to test resistance in the area of 2800-2850 points.

Переведено сервисом «Яндекс Переводчик»