What should an investor keep an eye on this week

The stock market may rise this week amid an improvement in the geopolitical situation. In addition, inflation continues to slow down, which gives hope for another reduction in the key rate before the end of the year. The value of securities of market participants will be affected by decisions on dividends and the publication of reports during the coming week.

On Monday, December 8, Renaissance Insurance shareholders will make a decision on dividends for the first nine months of 2025, Cifra Broker reported. On the same day, the opportunity to buy shares of Acron, a producer of mineral fertilizers, with the right to interim dividends ends, Finam said.

On December 9, Sberbank will disclose its RAS reporting for 11 months, BCS World Investments noted. Also on this day, the Henderson men's clothing store chain will publish revenue figures for November.

On Wednesday, the shareholders of the Polyus gold mining company and the Ozon retailer will make decisions on dividends for the first nine months of this year, Finam said.

On December 11, Aeroflot will disclose its operating results for November, and the shareholders of the Diasoft IT company will approve dividends for nine months, Gazprombank Investments said.

On Friday, December 12, the deadline for the purchase of shares of Europlan, IFC Zymer, Diasoft, Ozon and Polyusa with the right to dividends for the first nine months of 2025 ends, Cifra Broker noted.

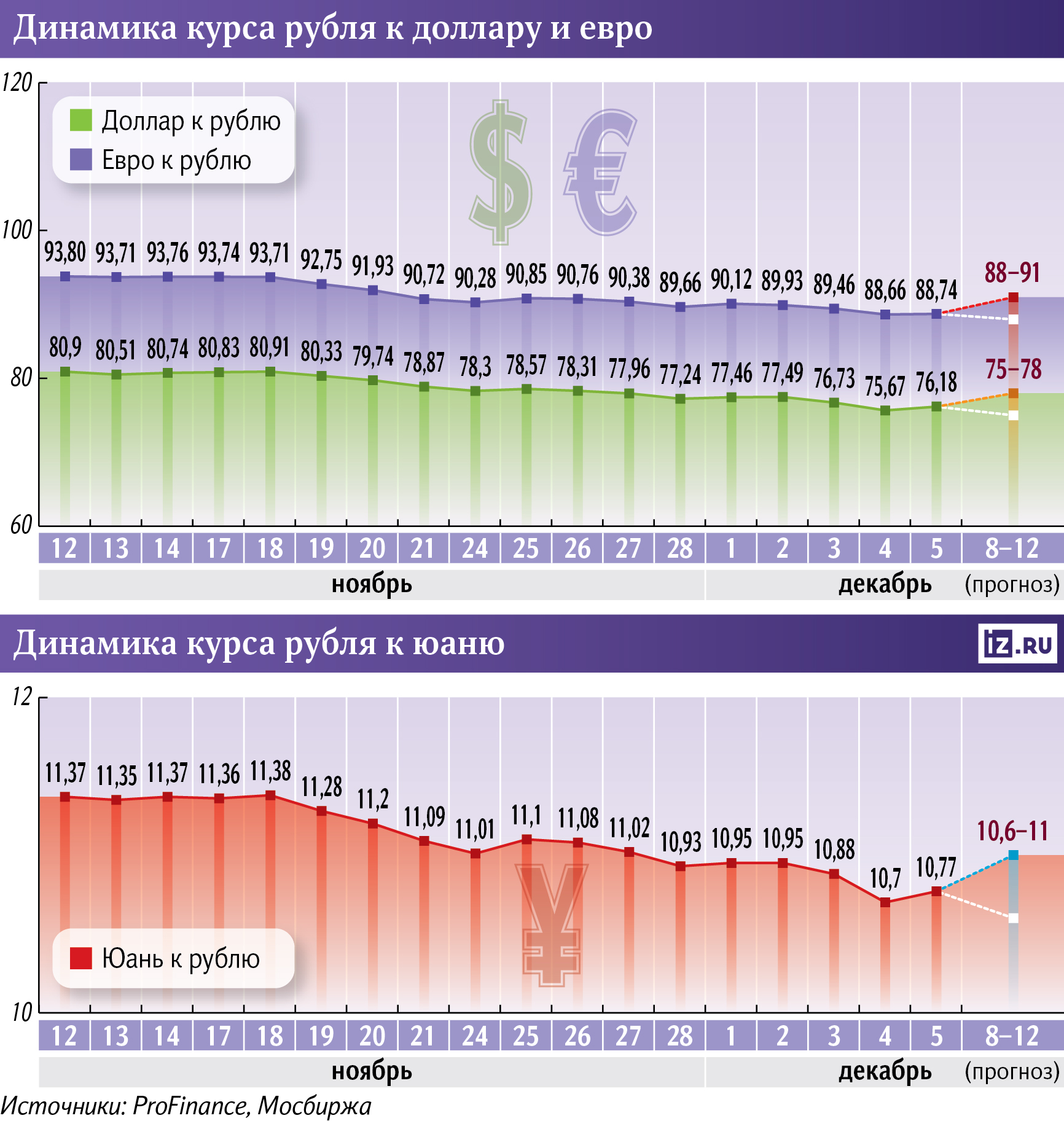

The RGBI government bond index is expected to be in the range of 117.5–118.5 points, Gazprombank Investments predicts. The ruble exchange rate in the foreign exchange market will remain volatile: the dollar, according to analysts, will be in the range of 75-78 rubles, the euro — 88-91 rubles, the yuan — 10.6–11 rubles. Experts expect positive dynamics in the stock market: the Moscow Exchange index may rise to 2,750-2,800 points as part of the continuation of the current trend, while geopolitical news remains a key factor.

Переведено сервисом «Яндекс Переводчик»