What should an investor keep an eye on this week

This week, Monday will be the last day for the purchase of Henderson shares before the closing of the register of shareholders with the right to interim dividends in the amount of 12 rubles per security. On the same day, CIAN shareholders will make a decision on dividends for the first nine months of 2025, said Natalia Pyrieva, head of the analytical department at Cifra Broker. There will also be reports for January-September from Aeroflot and Apri, Finam analysts said.

On December 2, Mordovenergosbyt will hold an extraordinary general meeting of shareholders. The issue of approving the nine-month dividends is on the agenda. In addition, the Moscow Stock Exchange will disclose data on trading volumes for November.

An extraordinary general meeting of RUSAL shareholders on dividends for the first nine months of 2025 will be held on Wednesday. The issue was raised at the request of SUAL, one of the major shareholders. Earlier, the board of directors recommended not to pay them, Finam analysts recalled. Also on this day, Rosstat will present a weekly inflation report, said Alexander Bakhtin, investment strategist at Garda Capital.

Russian President Vladimir Putin is scheduled to visit India in the second half of the week. He may also hold talks with US representatives on the implementation of Trump's "peace plan," the expert added.

On December 4, Zaymer and Europlan will hold an extraordinary general meeting of shareholders. The issue of approving dividends for nine months is on the agenda, said Anna Kokoreva, an expert on the stock market at BCS World of Investments.

MGKL will publish its operating results for 11 months of this year on Friday, Finam said.

The RGBI index has risen to fairly high levels, but the unstable geopolitical background slows down further upward movement despite the slowdown in inflation, Anna Kokoreva noted. According to her forecast, the index will continue to adjust next week and will go to the area of 116.

The Russian stock market reacts sharply to any statements in the field of geopolitics. Against this background, the Moscow Exchange index may experience bouts of increased volatility, but it will remain within the range of 2500-2700 points, Natalia Pyrieva believes.

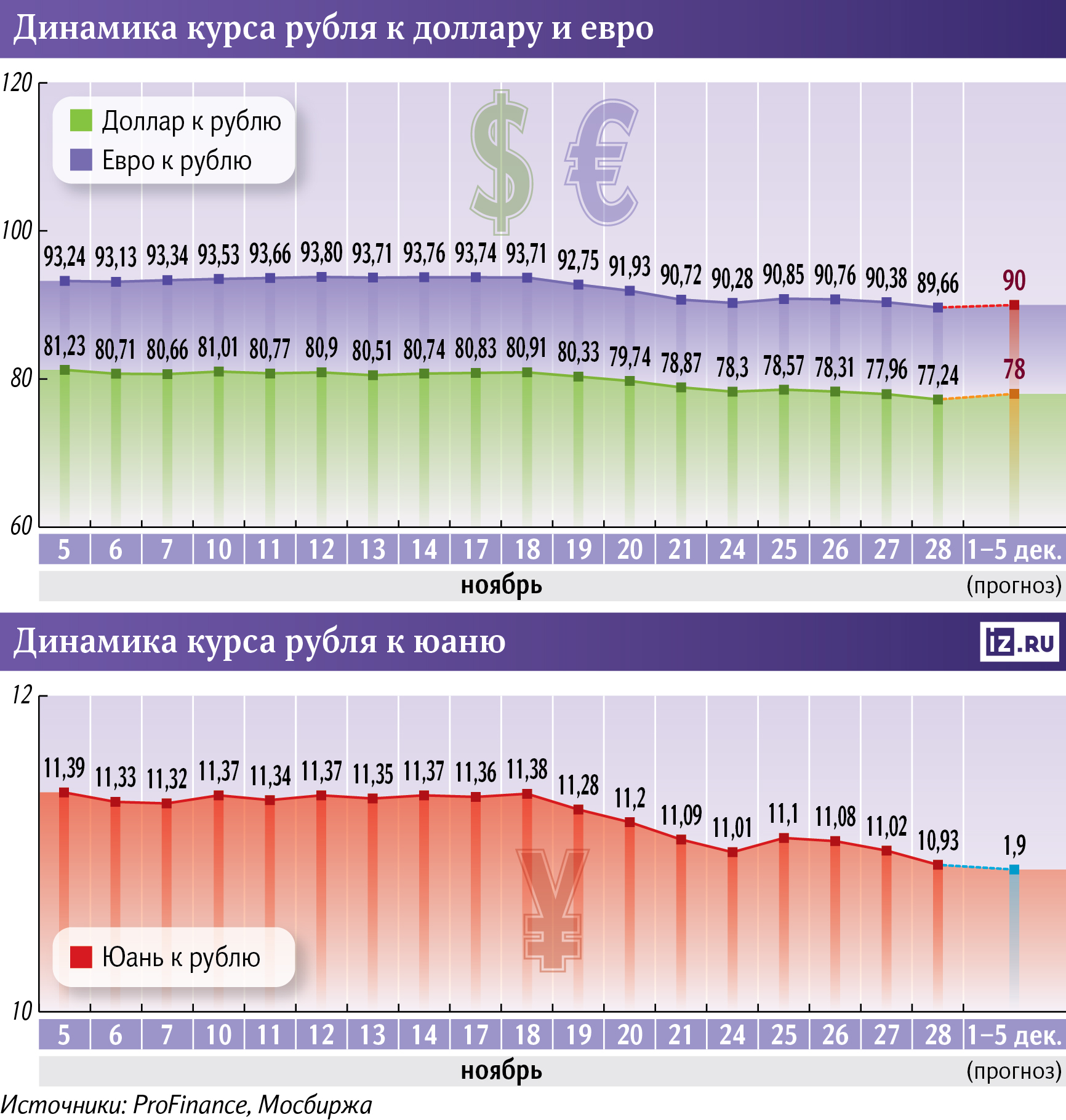

According to her, the trend towards strengthening the ruble in the foreign exchange market continues against the background of high interest rates in the economy and sales from regulators. This week, the ruble may test the strength of the peak levels of October — 78 rubles per dollar, 90 for the euro and 10.9 for the Chinese yuan.

Переведено сервисом «Яндекс Переводчик»