What should an investor keep an eye on this week

This week, the state-owned company "DOM.The Russian Federation" will enter the stock exchange, Finam reminded. The collection of investor applications for participation in the IPO will last until 13:00 Moscow time on November 19. In addition, several large Russian companies will publish financial statements and operating results at once. These events may affect the value of their shares.

On Monday, November 17, the Lenenergo energy company will publish the results for the first nine months, Finam said. On the same day, the boards of directors of Sibur and Rosneft will make recommendations on the payment of dividends, Cifra Broker added.

On November 18, the operational results will be shared by the Henderson men's clothing store chain, Promomed pharmaceutical company and MGKL pawnshop chain, Gazprombank Investments reported. In addition, the State Duma will consider the draft federal budget for 2026-2028 in the second reading, and this event may affect investors' expectations.

On Wednesday, Europlan leasing company and Rusagro agroholding will publish nine-month financial statements, BCS Mir Invest reported.

On November 20, trading in shares of the DOM.RF state corporation, which will launch an IPO, will begin. In addition, the Qiwi company will be delisted, after which the company's securities will cease to be traded on the Moscow Stock Exchange. Also on this day, Renaissance Insurance, IT company Softline, VK and T-Technologies will announce financial results for the third quarter and nine months of this year.

On Friday, November 21, Bank Saint Petersburg will publish its results for the same period, Cifra Broker reported.

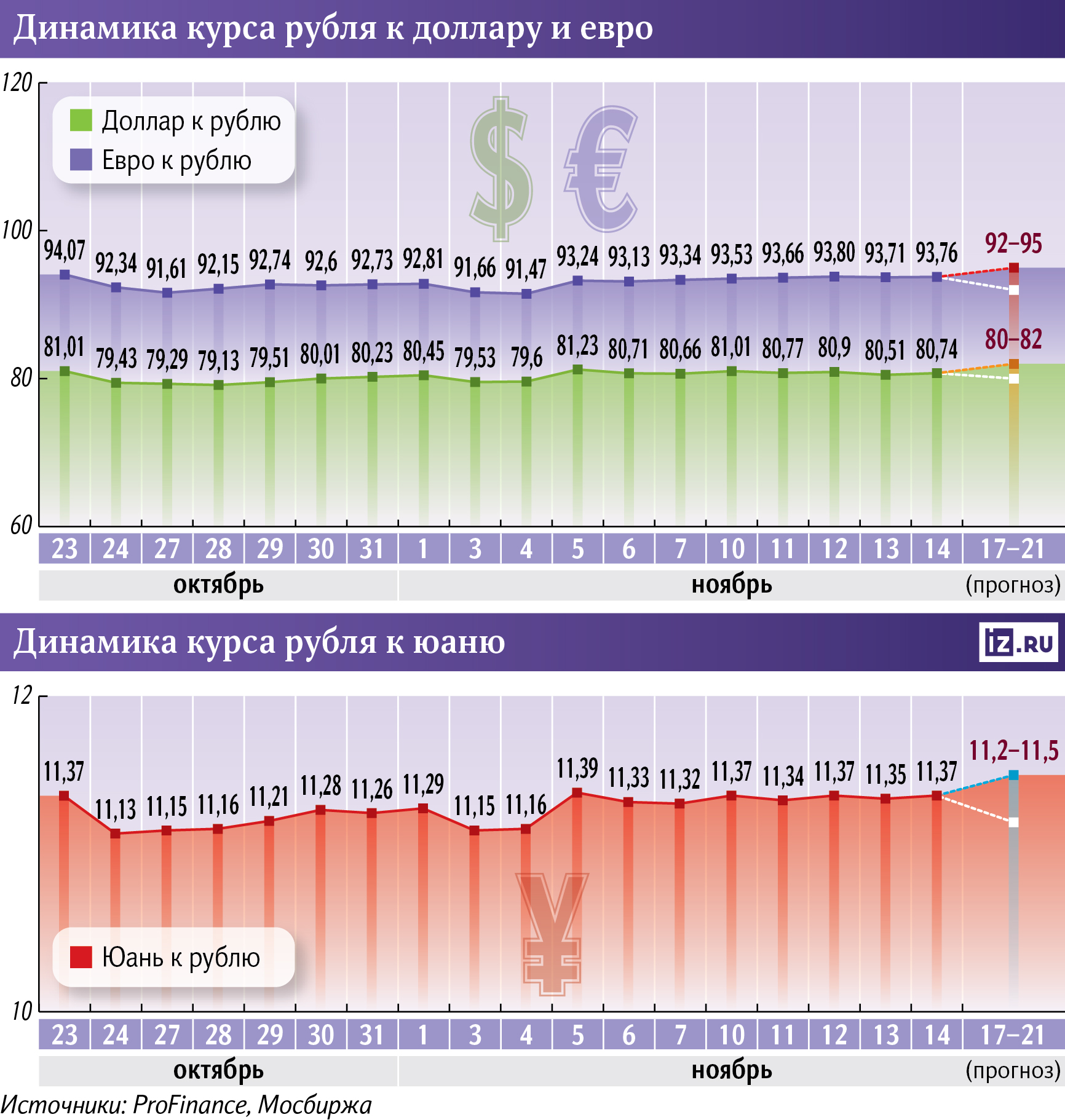

The RGBI government bond index will remain in the range of 117-119 points, Gazprombank Investments noted. The ruble exchange rate in the foreign exchange market will remain volatile: the dollar is forecast to be in the range of 80-82 rubles, the euro — 92-95 rubles, and the yuan — 11.2–11.5 rubles. Analysts expect neutral dynamics in the stock market: the Moscow Exchange index may fluctuate around the support level of 2,520 points.

Переведено сервисом «Яндекс Переводчик»