What should an investor keep an eye on this week

The focus of investors' attention this week will remain on geopolitics, mainly in terms of the continuation of negotiations on the settlement of the Ukrainian conflict, as well as sanctions news, said Alexander Shepelev, an expert on the stock market at BCS World Investments. According to him, there may be signals about the approval of another package of EU anti-Russian sanctions. The bidders will also evaluate the results of Russian President Vladimir Putin's visit to China.

The semi-annual reporting season has ended in the Russian market, and little corporate news is expected this week, Alexander Shepelev added.

On Monday, the Moscow Stock Exchange will report on trading volumes for August, and Ozon shareholders will discuss the issue of redomicilation (changing the company's jurisdiction).

On September 2, Promomed will hold a webinar for investors based on the results for the first half of 2025, said Natalia Pyrieva, a leading analyst at Cifra Broker. Also, according to her, the Moscow Stock Exchange will publish new databases for calculating indexes. Also on this day, the Bank of Russia will hold a press conference on the draft Guidelines for the unified State Monetary Policy for 2026-2028, said Alexander Bakhtin, investment strategist at Garda Capital. It may contain important signals for investors.

On Wednesday, Rosstat will present a report on the assessment of the consumer price index from August 26 to September 1, the expert added.

On Thursday, the Moscow Stock Exchange will launch trading in mini-futures on Polyus shares, said Alexander Shepelev from BCS World Investments.

The week will be the last before the September meeting on the key rate, and investors will evaluate the comments of the regulator's representatives on the prospects for the DKP, said Alexey Kovalev, head of the debt markets analysis department at Finam.

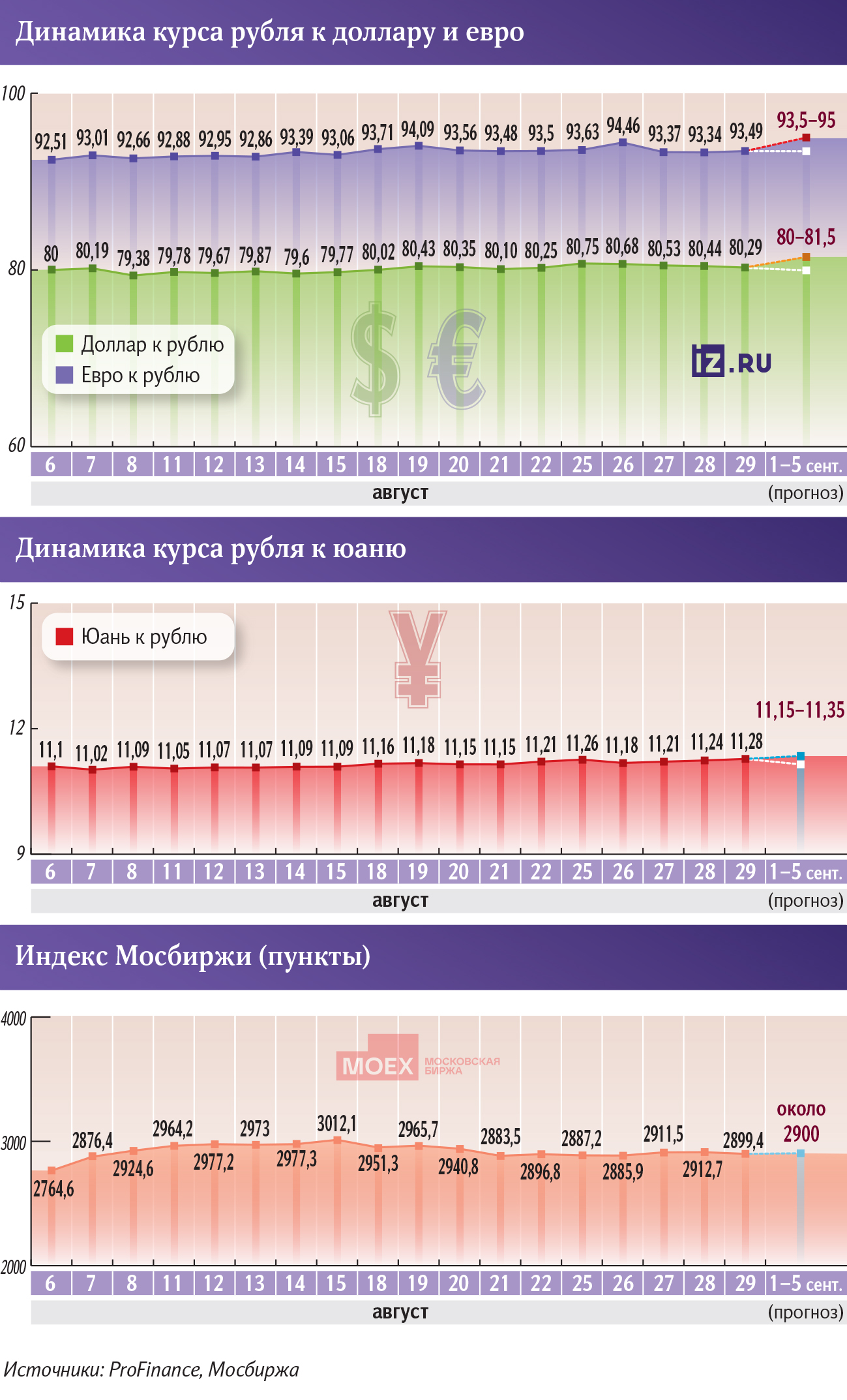

In the absence of external drivers, the Moscow Exchange index may remain sideways and hover around 2,900 points, predicts Alexander Bakhtin from Garda Capital. According to him, there are no reasons for the sales scenario: geopolitical uncertainty is offset by the expectation of a reduction in the Central Bank's key rate by 2 percentage points at once, to 16%. However, according to Natalia Pyrieva, there are still chances for a further recovery of the stock market in the direction of 2900-3000 points.

The dollar will trade at 80.0–81.5 rubles this week, the euro — 93.5–95 rubles, and the yuan - 11.15–11.35 rubles, Finam analyst Alexander Potavin expects.

Переведено сервисом «Яндекс Переводчик»