Canopy of gold: assets of Russian banks in precious metals have almost doubled

The volume of precious metals and stones in the assets of the banking sector jumped almost twice last year and reached 607 billion rubles at the beginning of December. This follows from the data of the Central Bank, which was analyzed by Izvestia. At the same time, the physical volume of gold in the reserves of financial institutions has also almost doubled to 6.3 tons. They increased investments in this asset against the background of its rise in price and increased demand from the population. Whether interest in precious metals will continue to increase and how much it will be possible to earn on investments in it this year is in the Izvestia article.

Why are banks increasing their investments in gold

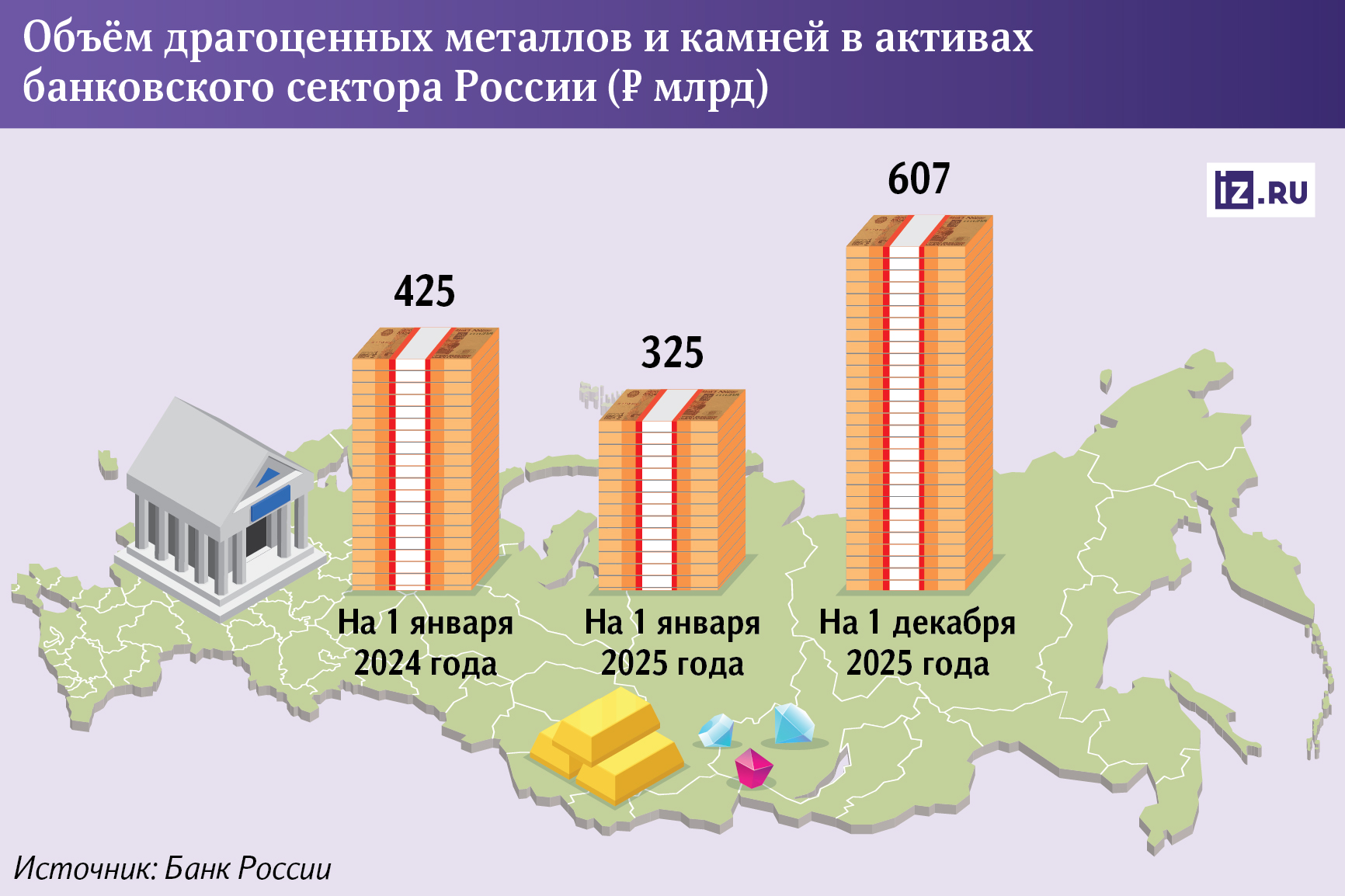

Investments of Russian banks in precious metals and stones increased sharply in 2025. As of December 1, their volume in the sector's assets reached 607 billion rubles, having increased almost 1.9 times since the beginning of the year. This follows from the statistics of the regulator, which was studied by Izvestia. At the same time, the dynamics was restrained a year earlier. In 2024, the figure even dropped from 425 billion to 325 billion rubles.

The main reason for the trend change was a sharp rise in the price of precious metals, primarily gold, experts say. By the end of 2025, its price increased by a record 65%, said Nikolay Dudchenko, an analyst at Finam. The increase in quotations automatically raised the value of precious metals in banks' assets, even without a proportional expansion of physical volumes. In 2025, the price of gold jumped from $2,630 to $4,300. On January 23, 2026, at 4 p.m., gold prices on the spot market reached $4,940 per ounce.

In conditions of geopolitical and economic uncertainty, precious metals retain the status of a key defensive asset and are used by banks to diversify balance sheets, noted in the Digital Broker.

An additional factor was the growth of investment demand. According to the PSB, the volume of gold on banks' balance sheets increased following the interest of citizens in investing in the precious metal. Thus, during the period of increased sanctions pressure, the volume of precious metals in gold equivalent in the banking system increased from 1.1 tons in 2020 to 2.8 tons in 2024. A new impetus came in 2025: in 11 months, the volume of precious metal in the banking system doubled and reached 6.3 tons, said Dmitry Gritskevich, Head of Banking and Financial Market Analysis at PSB.

The trend was also confirmed by VTB. In 2025, the bank actively acquired precious metals on the Russian market, increasing the volume of purchases by 20% compared to 2024, the press service of the credit institution reported. The bank attributed this to the growing demand from customers and the expansion of their base.

Demand from the population was also recorded by other market participants. The Rosselkhoznadzor noted the steady interest of customers in operations with precious metals both in physical form — ingots and investment coins, and in an impersonal form. At the same time, Sberbank indicated that in physical terms, the demand for gold in 2025 was comparable to the level of 2024, but due to rising prices, the volume of investments in ruble terms in metal accounts increased by 20%.

Why do Russians invest in gold and how much they can earn from it

Russians' interest in gold increased in 2025 amid a sharp rise in gold prices and increased uncertainty in global financial markets. According to the results of last year, precious metals rose in price by almost 65%, and silver — by about 150%, said Nikolay Dudchenko, an analyst at Finam Financial Group. This dynamic has made precious metals one of the most profitable defensive assets and has pushed investors to diversify their investments.

The growing interest in these assets is not only local, but also global. According to forecasts of the World Gold Council, in 2026, the world's central banks will purchase about 755 tons of metal. This is below the record levels of 2024-2025, when volumes exceeded 1 thousand tons, but the figure is still significant, said Andrey Smirnov, an expert on the stock market at BCS World of Investments. According to him, active purchases of gold by regulators support long-term demand and form a stable price trend.

At the same time, after a strong rally, gold has become a more attractive instrument primarily for traders, rather than for long-term investors. According to Andrey Smirnov, the high volatility of precious metals after the growth of 2025 increases the risks for investors with a long investment horizon, while short-term strategies will allow them to benefit from price fluctuations.

Despite this, the largest investment houses continue to revise their forecasts upward: Bank of America expects to reach $5,000 per ounce in the first half of 2026, and Goldman Sachs predicts growth to $5.4 thousand by the end of 2026, the expert recalled.

Russians use different tools to invest in gold. These include the purchase of bullion and investment coins, the opening of anonymized metal accounts, as well as investments through exchange—traded instruments such as funds, futures, and shares of gold mining companies. Physical gold allows you to directly own an asset, but it is associated with large spreads when buying and selling, storage and insurance costs, analysts say. Non-physical instruments are more liquid and convenient, but require careful selection of a bank, broker, or fund due to infrastructural and market risks.

According to experts, the future profitability of investments in gold will largely depend on the macroeconomic situation and the dynamics of the foreign exchange market. The BCS believes that the main profit from investments in it in 2026 will be brought by the weakening of the ruble. Due to this, Russian investors will be able to receive about 35-40%.

At the same time, Finam expects that in the long term, the price of gold may reach $5.4 thousand per ounce. However, analysts have no confidence in a repeat of the abnormal growth, as in 2025. Experts agree that interest in precious metals from banks and the public will continue, but investments in them in the coming years will require a more balanced and selective approach.

Переведено сервисом «Яндекс Переводчик»