- Статьи

- Economy

- Collect over: the budget received almost 3 trillion after the increase in income tax to 25%

Collect over: the budget received almost 3 trillion after the increase in income tax to 25%

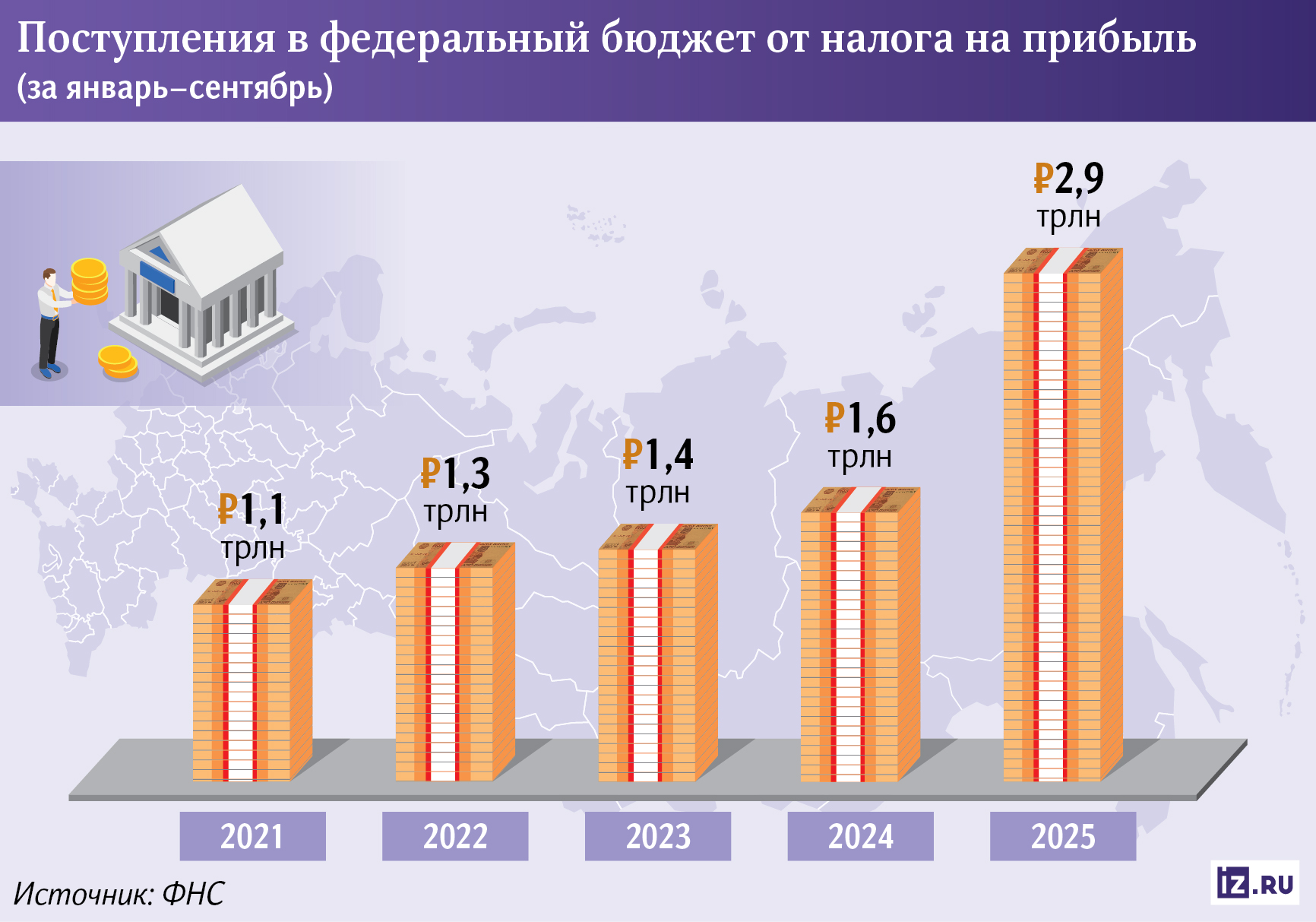

The federal budget received 2.9 trillion rubles from income tax in January – September 2025. The figure has become a record since 2013. After the increase in this fee from 20% to 25%, receipts increased by 82% compared to last year. They also increased for other major taxes: personal income tax — by 87% and VAT — by 23%. In general, the trend is associated with an increase in the rate, stricter control over business fragmentation schemes, an increase in tax collection, as well as an increase in salaries. At the same time, business profits are under pressure due to the key factors, which can slow down growth.

How much did the budget receive from income tax

Income tax revenues to the federal budget for the first nine months of 2025 increased by 82% compared to the same period last year, according to data from the analytical portal of the Federal Tax Service, which was studied by Izvestia. The figure reached 2.9 trillion rubles. This is a record since May 2013 (before that, statistics were kept by half-year). Receipts from other basic taxes also increased: personal income tax — by 87% (up to 269 billion rubles), and VAT — by 23%.

The main reason is the changes in tax legislation that came into force in 2025, said Vladimir Saskov, an expert at the Institute of Tax Management and Real Estate Economics at the National Research University Higher School of Economics.

Since this year, the income tax rate has increased from 20% to 25%. A fee of 8% is now sent to the federal budget instead of 3% (17% goes to the regional treasury). In addition, IT companies also began to pay income tax in the amount of 5%, said Vladimir Eremkin, senior researcher at the IPEI Structural Research Laboratory at the Presidential Academy.

— At the same time, if you pay attention to revenues to regional budgets, there is a decline of 2.5% (taking into account the fact that the rate of 17% remained unchanged), — he said.

In addition, the Federal Tax Service has recently shifted its focus from on-site business inspections to analytical analysis, which increases tax collection, the Presidential Academy noted. Some companies may close the debt after warning the Federal Tax Service. Digitalization also helps to speed up the process. Stricter control over business fragmentation schemes also leads to an increase in charges, they added.

As noted on the analytical portal of the Federal Tax Service, the increase in indicators is also associated with an increase in income tax receipts from income received in the form of interest on state and municipal securities.

The increase in personal income tax receipts was also influenced by the change in the taxation scale from this year. It has become a five—step system - for those who receive income over 2.4 million per year, the tax rate is:

— 15% — for earnings from 2.4 million to 5 million per year (from 200 thousand to 416.7 thousand rubles per month);

— 18% — from 5 million to 20 million per year (from 416.7 thousand to 1.67 million per month);

— 20% — from 20 million to 50 million per year (from 1.67 million to 4.17 million per month);

— 22% — from 50 million per year (over 4.17 million per month).

The increase in revenue was also influenced by an increase in average salaries in Russia, which have increased by about 15% since the beginning of the year, Kirill Tremasov, adviser to the head of the Central Bank, said in September.

The VAT rate has not changed, however, receipts have increased by 23% in the first nine months of this year. This can be explained by the growth in sales of goods, works and services, said Larisa Sorokina, associate professor at the Faculty of Economics of the Rudn University.

Izvestia sent a request to the Tax Service about what else could have affected the revenue dynamics.

Will it be possible to achieve the revenue forecast

In the financial plan, the amount of 4.2 trillion rubles is allocated for income from income tax. We can expect that receipts will approach this level by the end of the year, says Vladimir Saskov from the Higher School of Economics.

— The achievement of the corporate income tax plan will depend on the performance of the fourth quarter. Historically, some large payments may occur during this period. Therefore, achieving the target value of 4.2 trillion rubles is a realistic scenario," agrees Vladimir Eremkin from the Presidential Academy.

At the same time, a decrease in corporate profits may slow down growth, said Larisa Sorokina from RUDN University. In the first half of the year, the indicator decreased by 8.4% compared to last year.

Profits are under pressure from the high key interest rate, which is currently at 16.5%. This creates difficulties in attracting capital and investments, said Ruslan Kuleshov, CEO of the Clean Environment law firm and a member of the council of the Delovaya Rossiya MRO.

As Izvestia reported earlier, companies allocated more than 36% of profits to servicing loans at the end of September, which is a historical maximum. According to experts, this situation increases the risks of bankruptcies and defaults, accelerates inflation and slows down the economy.

Earlier, the head of the Bank of Russia, Elvira Nabiullina, said that the regulator expects to reach a neutral key range of 7.5−8.5% by 2027. As early as 2026, the Central Bank sees room for a rate cut.

Falling oil and gas prices, increased export sanctions, or a reduction in global demand may also negatively affect revenue, said Vladimir Chernov, analyst at Freedom Finance Global. At the same time, income tax is one of the main sources of revenue for the budget. This is especially important in conditions of a treasury shortage.

However, as noted in the Presidential Academy, optimism will remain against the background of high industrial workload, steady exports and a fairly favorable budget situation with prices for a number of raw materials.

Переведено сервисом «Яндекс Переводчик»