They got carried away: profitable oil reserves in Russia will last only for 25 years

Russia is one of the top 10 countries in terms of oil reserves and the leader in gas, however, according to Rosnedra, the volumes of raw materials that are profitable to extract will last only 25 years. Every year, their reproduction occurs only by two thirds at the expense of already open areas. At the same time, the Ministry of Natural Resources clarified that the country's resource potential is six times higher. Experts and market participants consider it necessary to increase investments in exploration. To what extent, at what cost of oil production is profitable and what are the prospects for exploration of new fields in general — in the material of Izvestia.

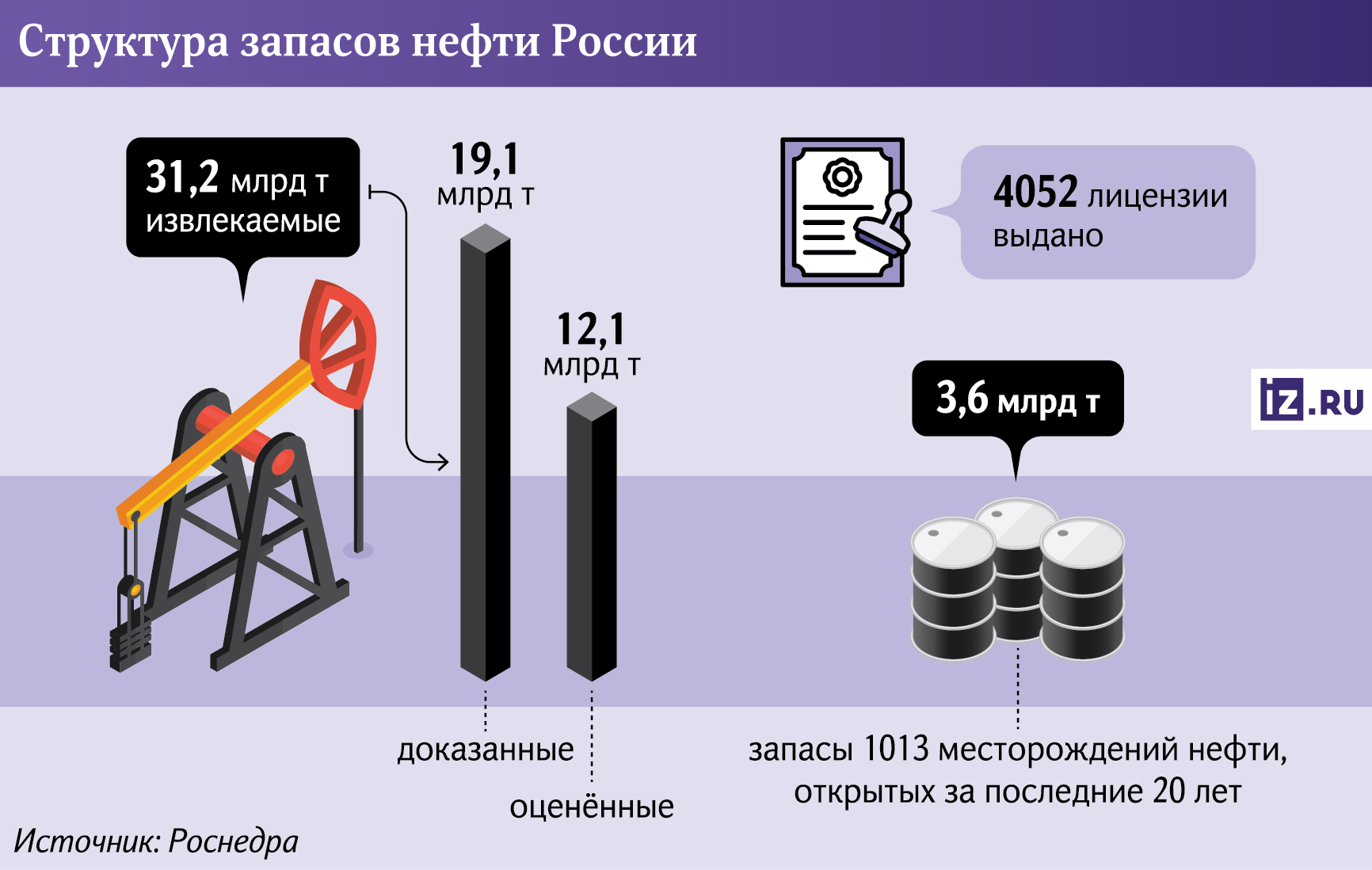

How rich is Russia in oil and gas

Russia has significant potential to increase its hydrocarbon reserves. According to the press service of the Ministry of Natural Resources and Environment, the volume of reserves prepared for drilling is 13.3 billion tons of oil and 34 trillion cubic meters of gas. At the same time, the country's total resource potential is much higher: 81.6 billion tons and 182 trillion cubic meters, respectively.

The head of the Ministry of Natural Resources and Environment, Alexander Kozlov, previously noted that oil reserves in the Russian Federation with current production will last for 26 years.

However, according to the presentation by Oleg Kazanov, head of Rosnedra, there are only 13.2 billion tons of profitable proven reserves of this raw material in Russia, which will be enough for 25 years of base production. He presented the report at a meeting of the State Council Commission on Energy within the framework of the Tatarstan Petrochemical Forum - 2025. (The document is at the disposal of Izvestia).

"To call a spade a spade, we have transferred almost all the objects with reserves to subsurface users,— he said, adding that the share of the distributed subsurface fund is 96%.

According to him, according to the results of auctions in 2024, one-time payments for hydrocarbon raw materials amounted to just over 4 billion rubles. At the same time, revenues from a less significant industry for the budget, such as loose gold mining, turned out to be twice as high.

— No matter how much we stimulate production at the existing fields, sooner or later they will run out. In our opinion, the task of changing the geography of oil production is very urgent," said the head of the Federal Agency for Subsoil Use.

According to him, it is necessary to expand the concept of hard-to-recover reserves (TRIZ) and increase investments in exploration. First of all, in early-stage geological exploration, in new regions. Oleg Kazanov noted that two-thirds of the reproduction is now being carried out through additional exploration of existing fields.

Valery Andrianov, Associate Professor at the Financial University under the Government of the Russian Federation, recalled that the increase in hydrocarbon reserves (primarily oil, since we have a high supply of gas reserves) is a joint task of the state and oil and gas companies, but its solution is clearly divided into stages.

"The state is searching for resources, that is, it reveals the very fact of their presence in the subsurface, while the task of companies is to explore licensed areas acquired at tenders and auctions, that is, to determine their real reserves," the expert emphasized.

What new deposits may be discovered in the near future

So far in Russia, according to the Ministry of Natural Resources, exploration is ahead of production. Thus, according to Rosnedra, the increase in recoverable oil and condensate reserves in 2024 amounted to 592 million tons, for natural gas — 708 billion cubic meters. At the same time, oil production amounted to 516 million tons, and gas — 685 billion cubic meters.

Last year, 39 new hydrocarbon deposits were discovered. The most significant are Ilginskoye in the Irkutsk Region, Mitikyakhskoye in the Yamalo-Nenets Autonomous District, Severo-Baykalovskoye in the Krasnoyarsk Territory, Nelyatskoye in Yakutia and the Nikolay Myshevsky deposit in the Irkutsk Region. Their total reserves are almost 290 billion cubic meters of gas, 39 million tons of condensate and over 21 million tons of oil.

The Ministry of Natural Resources and Environment clarified to Izvestia that the state is investing in regional (initial) stages of geological exploration in order to find areas with significant carbon reserves. Next, the business is engaged in search operations.

— At the moment, Yakutia is the most promising region. According to the results of the first stage of the federal project "Geology: the Rebirth of a Legend", six promising subsurface areas have been identified in the republic, and work has begun on 10 sites as part of the second stage of the federal project since 2025, the press service of the department emphasized.

According to the Ministry, investments of subsurface users in the exploration of hydrocarbons over the past five years have been stable and amount to about 300-320 billion rubles. In 2026, 11.5 billion rubles are planned to be allocated from the federal budget for regional geological exploration of hydrocarbons, the Ministry of Natural Resources and Environment added.

According to Valery Andrianov, due to the high geological level of the "old" and long-exploited oil and gas regions, the state has almost no potential areas left that could be offered to companies for research.

— Therefore, now companies are mainly focused on additional exploration of their existing assets — in other words, they are trying to find new oil and gas bearing formations in their own fields that have already been developed. It is cheaper than entering new regions, and more efficient in the short term, but at the same time less effective in the long term, such activities cannot lead to a complete recovery and increase in reserves, — said the interlocutor of Izvestia.

Izvestia has sent inquiries to the largest oil and gas companies in the Russian Federation.

Are investments in exploration sufficient

According to Dmitry Kasatkin, managing partner of Kasatkin Consulting, the companies' investments in exploration of 300 billion rubles seem significant, but they are mainly allocated to additional exploration of existing fields and maintenance of the current resource base.

— New regions and search account for a small proportion. Rosnedra's budget of 11.5 billion rubles is actually a level of support, not development. For comparison, only one full cycle of regional 2D seismic exploration in a large promising area can cost 3-5 billion rubles, 3D - from 5 billion to 10 billion, and drilling one parametric well with a depth of over 4 km — another 2-3 billion rubles, the expert notes.

Thus, according to Kasatkin, a valuable exploration program in poorly explored areas requires more than ten billion dollars annually, that is, many times more than the allocated funds, this is "without taking into account simpler work such as aerial photography and electro-gravity-magnetic exploration."

He also stressed that Russia's resource base is comparable to Saudi Arabia and Venezuela (the world leader in oil reserves), remaining among the countries with the largest reserves. But the qualitative structure of stocks varies. Saudi Arabia, despite its gradual depletion, still has light and cheap oil resources, Venezuela has ultra-viscous and capital—intensive resources, and we have a significant share of hard-to-recover reserves in mature areas, as well as in new and difficult-to-develop regions such as the Arctic and Eastern Siberia.

"This means that in order to maintain production at the current level, Russia must invest more actively in regional exploration, and in 10-15 years reproduction through additional exploration of old assets will exhaust itself,— Dmitry Kasatkin emphasizes.

According to Valery Andrianov from the University of Finance, the potential for the discovery of new large deposits is almost exhausted, and the discovery of medium—sized deposits is very rare. In this regard, it is necessary to enter new regions, as well as to explore the deposits of so-called unconventional oil.

— It is necessary to clearly place accents in the exploration process, that is, to decide which areas we will rely on first. It is clear that they are complementary, not mutually exclusive. Nevertheless, we must understand that we do not have enough opportunities for the development of new regions and, for example, for the large—scale development of unconventional deposits," the expert believes.

In addition, according to him, the volume of profitable reserves may decrease as a result of more detailed geological exploration, as well as due to lower oil prices.

— That is, those reserves that it is advisable to extract from the depths at quotes of $ 60-80 per barrel may turn out to be unprofitable at prices of $ 50, — he noted.

This means that it is necessary to strengthen our mineral resource base both by searching for new deposits and by additional exploration of existing reserves, the expert concluded.

Переведено сервисом «Яндекс Переводчик»