Loan work: Loan disbursements jumped after key rate cut

Banks increased their lending after the key rate cut — by the end of June, they jumped by 13% for the first time in six months, Izvestia found out. Market participants are trying to issue more expensive loans before the Central Bank's policy softens again. Moreover, the difference between loan and deposit rates is increasing. The real cost of loans exceeds 34%, and the yield on deposits has already been lowered to 18%. However, loans may still fall in price in the near future — experts expect a decrease in the key rate. When loans will become available to Russians — in the Izvestia article.

How much have loans increased?

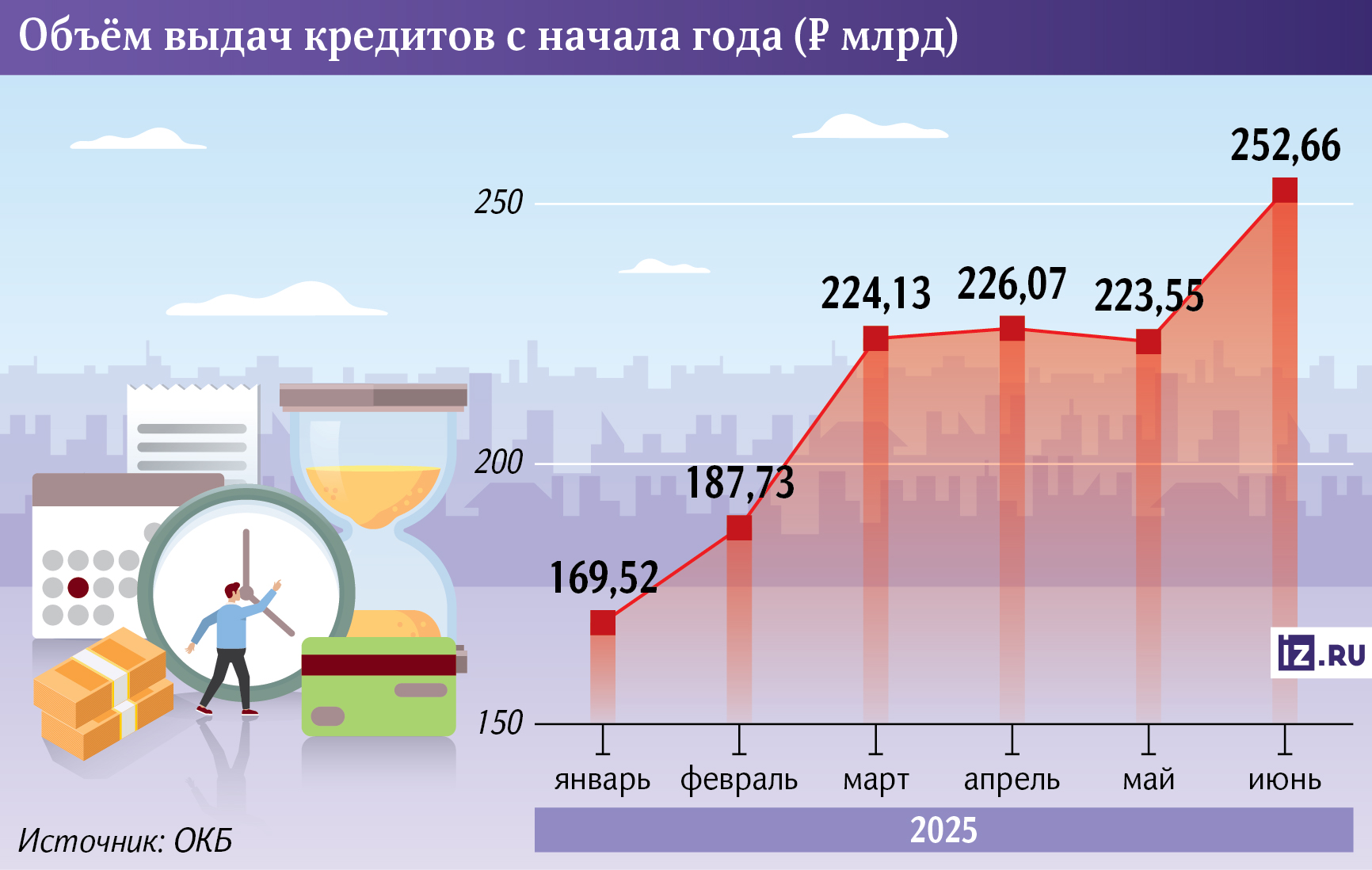

The volume of cash loans increased by 13% in June, to 252 billion rubles, according to data from the United Credit Bureau, which was studied by Izvestia. This is the maximum since October 2024 - the market has been under pressure for six months due to the record high key interest rate of 21%. The trend reversal occurred after the Central Bank lowered it to 20% following a meeting on June 6.

— Banks have started to lower retail loan rates slightly following deposit rates and in anticipation of monetary policy easing. This could stimulate credit activity," said Mikhail Doronkin, Managing Director of the NKR Rating Agency.

The Savings Bank confirmed the growth in demand for loans, where loans jumped by 35% in a month and exceeded 113 billion rubles, the organization's press service said. In the future, the market will continue to react to possible rate changes.

VTB also sees an increase in demand for loans — they note the role of the seasonal factor, because Russians traditionally lend more in the summer, the bank's press service said. The RSHB did not record a significant increase in the activity of borrowers, the representative of the organization said. Izvestia sent inquiries to other market participants.

At the same time, real loan rates are still at a barrier level. According to the National Bureau of Credit Histories (NBKI), they dropped to only 34% in June. Although after the Central Bank meeting at the beginning of the month, less than half of the market players changed the loan conditions.

"Banks are probably trying to provide more loans now, before the key interest rate drops even lower," said Vladimir Chernov, analyst at Freedom Finance Global.

Why don't banks reduce their borrowing rates

Almost all banks reduced deposit rates almost immediately after the Central Bank meeting, and the average yield dropped below 19%, Izvestia reported earlier. It turns out that market participants are much more willing to worsen deposit conditions than to reduce the cost of loans.

Banks issue loans for the money they attract through deposits, and their profitability directly affects the cost of loans. But in addition to the cost of paying interest on deposits, banks are also spending on reserves, including on problem loans, the share of which is growing.

It turns out that market participants are currently in very favorable conditions. Even Russian President Vladimir Putin noted that the margin of Russian banks is at 5.7%, which is one and a half times higher than that of foreign credit institutions.

Lending volumes largely depend on banks' appetite for risk and the proportion of approvals for applications. To get more income, they can increase the issuance of loans to the most solvent borrowers who can handle high rates, said Yuri Belikov, Managing director of the Expert RA rating agency.

When will the key rate be lowered

Lending in the Russian Federation remains very slow due to the barrage of interest rates, which have become a way for the Central Bank to cool the market. The regulator has repeatedly noted that the economy is not keeping up with overheated demand. It is supported by loans, but the economy needs time to rebalance.

Nevertheless, in June, seasonal inflation in Russia slowed to the Central Bank's target level (about 4%). The regulator will wait for the trend to consolidate, but now we can talk about the prerequisites for further easing of monetary policy.

— We have practically no doubt about the reduction of the key rate in July and estimate this probability at 80-90%. The main issue is the step of this decline," emphasized Vladimir Chernov of Freedom Finance Global.

The central Bank may lower the key rate by up to 18%, Anna Zemlyanova, chief analyst at Sovcombank, expects. Absolut Bank allows for a 1 percentage point reduction in the rate, and this option is already included in the profitability of deposits.

— The Bank of Russia has announced and confirmed the beginning of monetary policy easing, which will continue for the foreseeable future. This is a clear signal for banks to revive lending," said Yuri Belikov from Expert RA.

In July, loan disbursements will continue to grow, said Maxim Petronevich, head of the Center for Macroeconomic and Regional Analysis and Forecasting at the RSHB. A possible reduction in the key rate will lead to lower loan rates, which will make them more affordable. According to Vladimir Chernov, disbursements can grow by 15-20% already by the end of the third quarter.

Переведено сервисом «Яндекс Переводчик»