Under an incomplete program: banks may limit the issuance of preferential mortgages

Banks may limit the issuance of preferential mortgages. The Ministry of Finance and the Central Bank saw such risks after the market refused to charge fees from developers, Izvestia found out. Now government programs have become less profitable for credit institutions, as a result, they may tighten the standards of disbursements and increase the amount of the initial payment on housing loans, the regulator admitted. In May 2025, lending under government programs has already decreased, according to Dom.RF data. What difficulties borrowers may have and what the authorities will do is described in the Izvestia article.

The authorities will monitor the issuance of mortgages under government programs

The Finance Ministry has learned that banks may limit the issuance of preferential mortgages, Deputy Finance Minister Ivan Chebeskov told Izvestia. According to him, the agency agreed with the Central Bank to study the market situation after the major players abandoned the practice of charging fees from developers.

She began to leave the market in May 2025. And before that, in the last few years, if a developer wanted to sell housing under a state program, he had to pay an additional 4-10% per annum for each apartment — in fact, to co-finance a preferential loan. This happened because due to the high key issue of government programs, they became unprofitable for banks. The authorities fought with such commissions: even the president spoke out against it. However, now banks can again complicate the registration of loans for housing with state support.

— We have agreed with the Central Bank that we will monitor the situation and see how the banks behave. We don't have a clear answer on what measures will be needed," Ivan Chebeskov said.

The press service of the regulator confirmed to Izvestia that banks can now tighten the standards for issuing preferential mortgages. For example, to increase down payments for more risky groups of borrowers.

"Banks do note that the rejection of "subsidies from developers" may lead to a decrease in government—backed mortgages," the Central Bank's press service clarified.

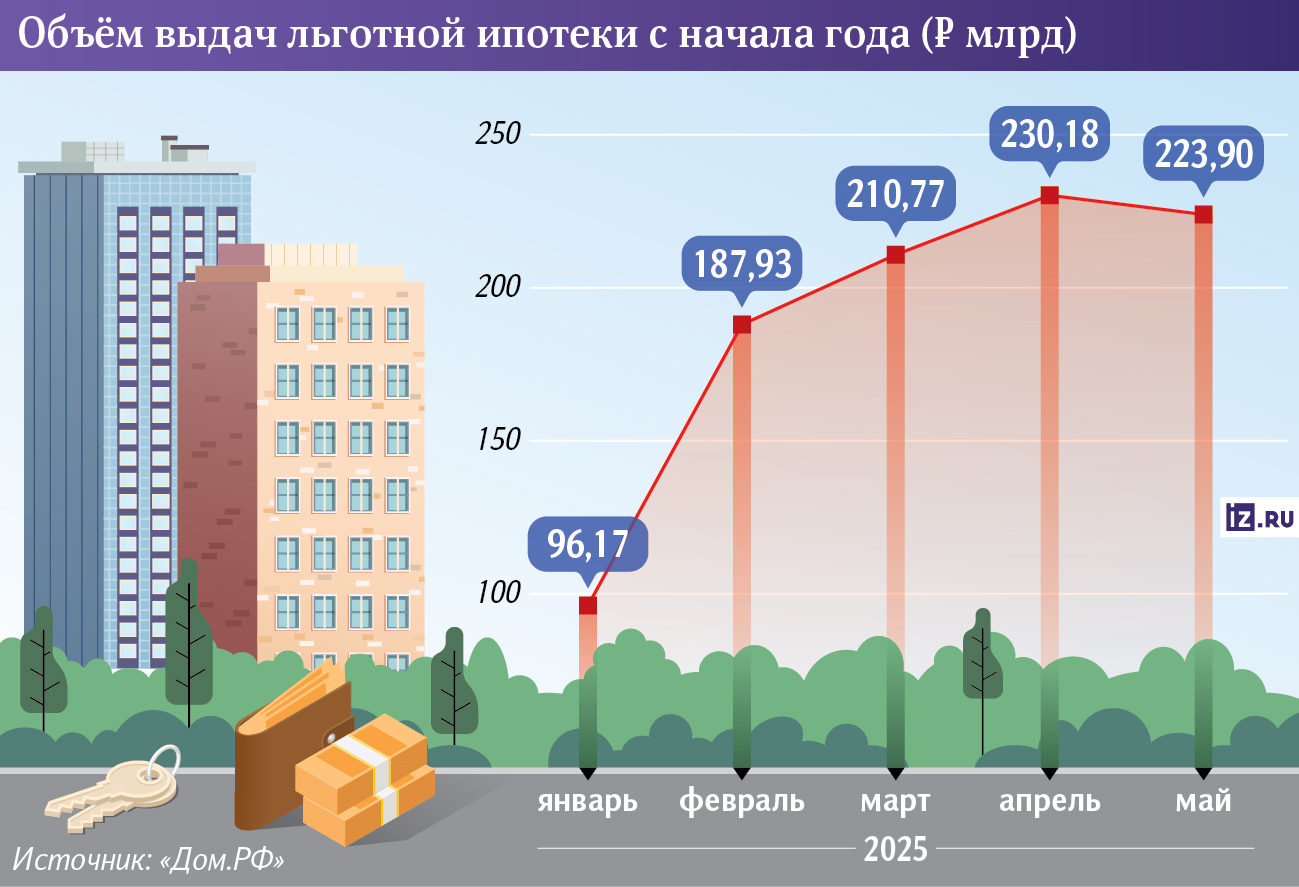

The first signs of cooling are already visible. By the end of May, the volume of preferential mortgage loans stopped growing and even decreased slightly, reaching 224 billion rubles, according to Dom.RF data. At the same time, they have been continuously growing since the beginning of the year.

It should be borne in mind that the issues are reflected in the statistics with some delay, said the head of the analytical center "Dom.Russian Federation" by Mikhail Goldberg. For example, the May figures are the result of applications approved in April. Thus, the real decline in market indicators has yet to be assessed.

However, the Central Bank noted that disbursements in May could decrease due to long holidays. The situation should be finally clarified only by the end of June-July.

In general, the Bank of Russia does not see a "drawdown" of the market, and also does not set itself the goal of stimulating the issuance of preferential mortgages, the regulator's press service said. Therefore, additional support for this segment will not be required, they are confident.

Preferential mortgage terms in 2025

Banks can change only a part of the parameters of a preferential mortgage. For example, the rates on government programs are fixed — players cannot raise them, said Vladimir Chernov, analyst at Freedom Finance Global. For a family mortgage, this is 6%, for a Far Eastern mortgage — 2%.

However, they may indirectly shift part of the costs to the client, for example, by insisting on taking out insurance or introducing additional fees, the expert suggested. They also have the right to raise the minimum initial payment level.

— It is likely that the availability of programs will become selective and large cities, liquid new buildings and reliable borrowers will remain a priority, — said Vladimir Chernov.

The required minimum level of the client's monthly income and his maximum debt burden may also increase, noted economist Andrey Barkhota. This will cut off many potential borrowers, and the approval rate for applications will drop.

Nevertheless, this will have the greatest impact on developers — due to falling demand, new buildings may not be sold, Vladimir Chernov said. It is possible that because of this, market participants will go to lower prices or sell housing at discounts.

Why does the bank not issue mortgages under the state program

While deposit rates remain high, issuing preferential mortgages without developer fees is unprofitable for banks, Mikhail Goldberg from Dom.RF emphasized. Although the government reimburses the amount of annual interest on preferential programs equal to the key rate (currently 20%) + 3.5 percentage points (that is, in the amount of 23.5%), such a product is still not marginal for banks. Under normal conditions, they could earn a third more on such a loan, because real market mortgage rates reach 35%.

The Central Bank is confident that cheaper funding for banks against the background of lower key rates will increase the profitability of government programs. However, even its further reduction by another 2-3 percentage points is unlikely to have a noticeable effect, said Vasily Kutyin, Director of Analytics at Ingosstrakh Bank. According to him, for this, deposits should become cheaper by about 8-10% per annum.

Banks cannot increase lending on products that are obviously unprofitable for themselves, Mikhail Goldberg emphasized. Against the background of the refusal of commissions from developers, they can reduce the number of approvals for government programs and their issuance in the future, he agrees.

How to increase the issuance of preferential mortgages

"It is unlikely that banks will be able to increase the issuance of preferential mortgages themselves without government support," said Oleg Abelev, head of the analytical department at the Rikom—Trust investment company.

One of the options is to increase compensation to banks from the budget, said Anna Zemlyanova, chief analyst at Sovcombank. But this may put too much strain on the treasury.

Banks are already in dialogue with financial authorities to improve the effectiveness of government programs. The VTB press service clarified that the organization is discussing such proposals with the Central Bank and the government. Izvestia has sent inquiries to other major market participants.

Given the high social importance of family and Far Eastern mortgages, the authorities can increase their influence on state-owned banks to support the volume of loans, Vladimir Chernov added. According to him, government programs today remain the only way for many Russians to buy their own homes.

Nevertheless, preferential mortgages have introduced many imbalances into the market, Andrei Barkhota noted. The injection of money into housing construction has led to an increase in prices for new buildings, overheating of the real estate market and an increase in budget expenditures.

If government program disbursements slow down and become more targeted, this will be more likely to be good news for both the Central Bank and the Ministry of Finance. Therefore, they can refuse direct intervention and perform the function of a "night watchman" who will actively influence the situation only as a last resort.

Переведено сервисом «Яндекс Переводчик»