- Статьи

- Economy

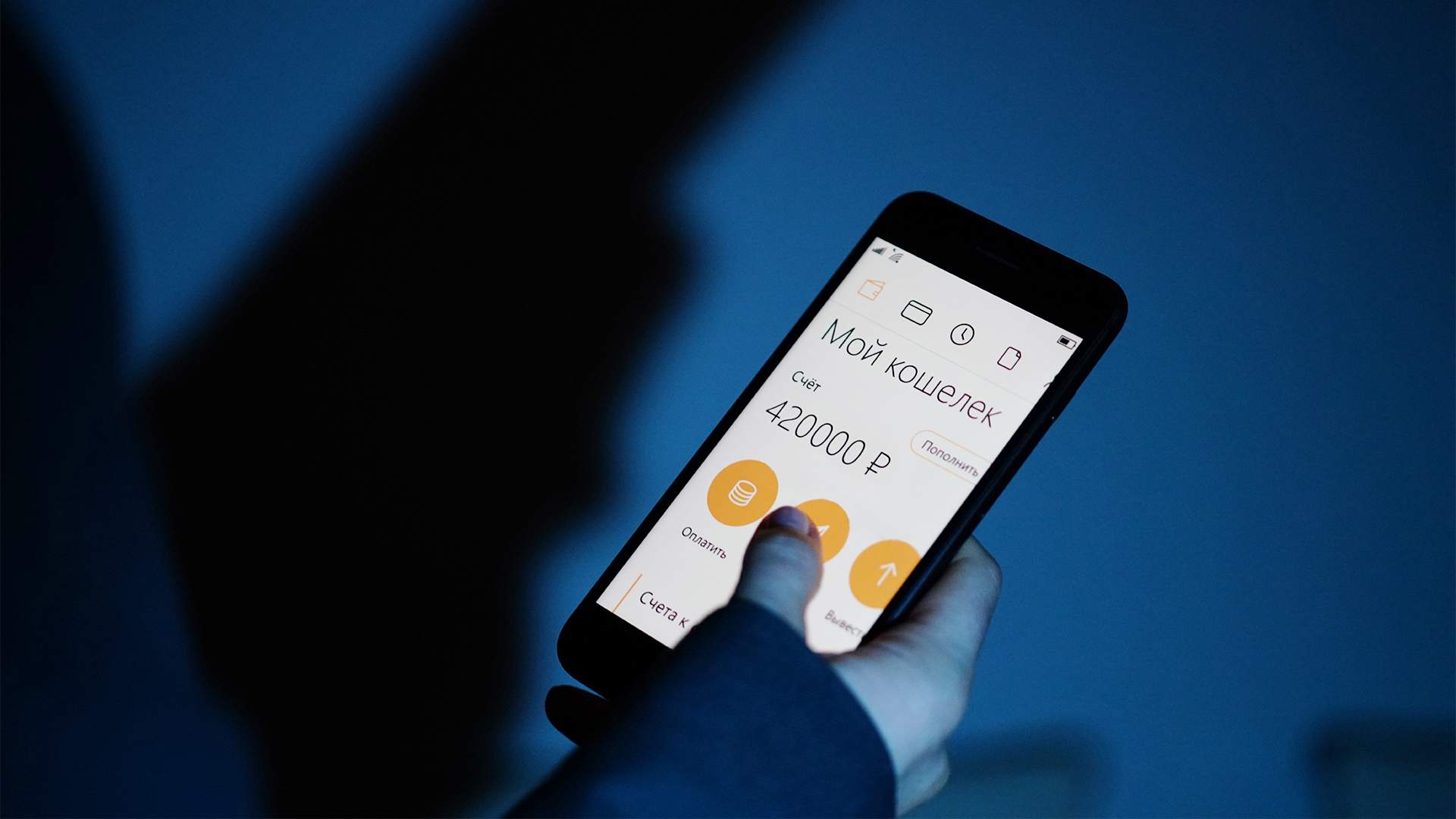

- Protection of the mechanism: insurance of funds on electronic wallets is planned to be launched in 2025

Protection of the mechanism: insurance of funds on electronic wallets is planned to be launched in 2025

A bill on the insurance of funds on electronic wallets up to 1.4 million roubles may come into force as early as 2025, the State Duma told Izvestia. The Central Bank supports the initiative - the regulator noted that it will help protect Russians' money. Although people rarely keep large sums on electronic wallets, the issue became acute after the revocation of the license of Qiwi-bank - its accounts held about 4 billion rubles. How the changes will affect the popularity of these services - in the material "Izvestia".

How e-wallets will be insured

The bill on insurance of funds on electronic wallets will be presented at the beginning of next year, said "Izvestia" head of the State Duma Committee on Financial Markets Anatoly Aksakov. The document may come into force as early as 2025. While the initiative is being prepared for introduction, but they plan to consider it promptly, as it is aimed at protecting the money of Russians.

- We are talking about citizens' funds, so we will strive to adopt it faster," Anatoly Aksakov said.

The Bank of Russia conceptually supports the bill, the regulator's press service told Izvestia. Now the initiative is at the stage of discussion with the Ministry of Finance. The editorial board asked the agency a question about it.

The indemnity limit will not exceed 1.4 million rubles (in aggregate with funds in ordinary bank accounts and deposits of citizens in this financial organization), the Central Bank specified. At the same time, the funds will be insured only on confirmed electronic wallets (those where a person has been fully identified). Only in this case it will be possible to identify the recipient of the insurance payment.

- Implementation of the initiative will allow to protect electronic money of citizens, minimizing the risks of their loss, - emphasized the Central Bank.

Electronic wallets are becoming an integral part of everyday life of Russians, and the number of their users is constantly growing, so the initiative reflects the current realities of the Russian economy, emphasized Anatoly Aksakov.

If the law on insurance of funds on e-wallets is adopted, the Deposit Insurance Agency (DIA) will ensure its implementation within its authority, its press service told Izvestia.

What threats are there for users of electronic wallets?

E-wallets were originally created for payments on the Web, not for accumulation of funds, emphasized the press service of UMoneu (former "Yandex.Money" - now the service belongs to "Sber"). DIA insures exactly the account balances, but there are less balances on electronic wallets, because most users do not use them as the main means of payment.

- We do not see any threat to our clients, as we comply with all regulatory standards. The money of our clients is safe, - said in UMopeu.

"Izvestia" asked to comment on the initiative and other companies - operators of electronic wallets, such as PayPal and Payeer.

Nevertheless, the bill will affect the psychology of e-wallet owners - thanks to insurance they will be able to keep more funds there without fear of losing them, explained Freedom Finance Global analyst Vladimir Chernov. That is why the initiative will support the popularity of such services in the Russian Federation.

Of course, the relevance of the bill has increased after the revocation of Qiwi-bank's license from February 21, 2024, recalled economist Andrei Barkhota. Because of this, the funds of many Russians were jeopardized. As stated earlier in the DIA, the bank opened a total of 9.3 million Qiwi wallets, which held about 4.4 billion rubles - more than half of this amount was stored in accounts with simplified identification (when opening which passport data does not need to be confirmed in the office).

The funds on Qiwi wallets were not insured by the DIA, said Georgy Nikonov, general director of the Vepay payment service. So far, holders of electronic wallets have no guaranteed way to get their money back if the service is discontinued. Insurance provides just such a mechanism.

Why electronic wallets are needed

E-wallets are most often used for online payments on the Internet, subscriptions to digital and gaming services and transfers between individuals, said Georgy Nikonov from Vepay. In addition, they can be used to pay utility bills, cell phone bills or fines, said Vladimir Chernov from Freedom Finance Global. However, such services are also involved in buying and selling cryptocurrency and paying for illegal goods and services.

10-15 years ago, e-wallets were heavily relied upon as a convenient payment solution for households and small businesses, recalled Andrei Barkhota. But this forecast did not come true - they occupied their niche in payments in the mode of full or partial anonymity. Very often users of such wallets were citizens or representatives of microbusinesses, including those associated with the shadow sector. Fraudsters use them to get money from phishing, blackmail, selling non-existent goods on fake websites or paying fake fines.

Cybersecurity in the Russian Federation has received special attention in recent years, so the growing attention of the authorities to e-wallet operators is a positive for users, emphasized Vladimir Chernov.

Nevertheless, in the period of high interest rates, it is basically unprofitable for clients to place money there, warned Andrei Barkhota. Savings accounts and deposits allow you to get a return of up to 20%.

At the same time, it is now e-wallets that help Russians to bypass the blocking of foreign services, said Georgy Nikonov. They are also used to buy cryptocurrencies or cross-border payments quite legally, added Andrei Barkhota. This tool has carved out its own niche, and its users should be protected on an equal footing with others.

Переведено сервисом «Яндекс Переводчик»