Word for word: it's increasingly difficult for scammers to reach users of telecom operators and ecosystems

- Статьи

- Economy

- Word for word: it's increasingly difficult for scammers to reach users of telecom operators and ecosystems

Cybercriminals are becoming more and more inventive — the days when simple antiviruses and spam filters could protect against them are long gone. Russian banks, telecom operators, and digital companies offer them a variety of security options designed to prevent a fraudster from reaching a potential victim and tricking her out of money. At the end of 2025, J'son & Partners Consulting found out which Russian ecosystem players and telecom operators have the most comprehensive set of security tools and which ones work best. See the Izvestia article about how participants in the domestic market build cyber protection for their clients.

How a business protects customers from scams and spam

Scammers are becoming more sophisticated by the day, and the means to combat them are becoming more and more sophisticated. This conclusion can be drawn by following media reports, relevant departments, as well as IT and digital companies with developed ecosystems.

No one doubts that fraud in Russia has reached truly cosmic proportions. In particular, according to a survey conducted in May this year by the Public Opinion Foundation, 73% of Russians called phone scammers, and 9% lost money because of them. MTS alone blocked more than 2.5 billion unwanted calls from January to October, which is 10% more than a year earlier, according to J'son & Partners Consulting in its study of challenges and threats to information security in the digital environment.

As of September 2025, the Antifraud system and the Roskomnadzor functional service verify from 400 to 600 million calls every day and block from 1 million to 2 million calls with signs of number substitution, it says.

The response to this was a number of anti-fraud measures by the government and business. So, in 2025, a law was signed that prevents the execution of monetary transactions without the consent of the client or with consent obtained under the influence of deception or abuse of trust. The law on countering cyberbullying was adopted, and in August 2025, the Ministry of Finance of the Russian Federation prepared a second package of measures to combat cyberbullying, which included about 20 initiatives.

In turn, businesses are taking technological measures to counter fraudsters. At the end of this year, J'son & Partners Consulting conducted an analysis of the digital security services of the main players in the Russian ecosystem market, as well as companies specializing in information security (Kaspersky Lab). The analysts focused on the services of protecting the largest Russian companies from spam and fraud in its various forms. According to the results of the study, MTS mobile operator became the leader among integrated solutions: in the overall ranking, the company received 45.8 points on the 50-point scale of J'son & Partners Consulting. It is followed by other mobile operators, including MegaFon (36.2 points) and T2 (35.2 points).

"MTS offers the most comprehensive offer in terms of completeness, variety and functionality of subscriber digital security services," the researchers emphasize. They emphasized that MTS demonstrates the most comprehensive functionality in several key categories at once.: anti-spam services (MTS, MegaFon and T2 are among the top 3 in this indicator, as well as anti—fraud services such as the T2, MTS and Sbera anti-fraud systems). Experts also considered these same market players to be the best in the category.

Operators, banks and digital companies strive to protect their customers from a wide variety of threats, according to a study by J'son & Partners Consulting. The most common services are caller ID and spam call blocking: almost all market players have them, experts emphasize. "In the segment of anti—spam services, MTS and MegaFon offer the most comprehensive offer due to the most diverse set of functionality," its authors believe. So, in MTS, and along with it in Yandex, Beeline, MegaFon and T2, it is possible for the AI secretary to send recordings, transcripts or Sammari calls to messenger or email, they note.

As for services aimed at combating fraudulent activities, MTS also offers the most diverse functionality in this area, the researchers believe. On the scale of J'son & Partners Consulting, MTS received the highest rating among the studied companies — 10.8 out of 12 possible points (followed by large Russian banks and cellular companies). As an example of anti—fraud services, analysts cite the "Protection of loved ones from scammers" launched by MTS and MegaFon, which will disconnect conversations with intruders and inform the client about it.

The applications of Sberbank Mobile, MTS, Kaspersky and some other players have a function that shows the user's security level in digital format, which J'son & Partners Consulting also considers important. If the user is completely safe, the indicator lights up green, and if there is a risk, the indicator turns red.

In addition, MTS, Sberbank, T2, Rostelecom, and Kaspersky have a "Data Leak Notification" feature that allows them to track subscriber data when it leaks into the Network and make recommendations to prevent such situations, the authors of the report also emphasize. "At the time of the study, most operators (MTS, Beeline, MegaFon, T2) offer antivirus protection in collaboration with Kaspersky. As a rule, such a set of services is offered as an additional paid option," it also says.

What the anti-fraud services test drive showed

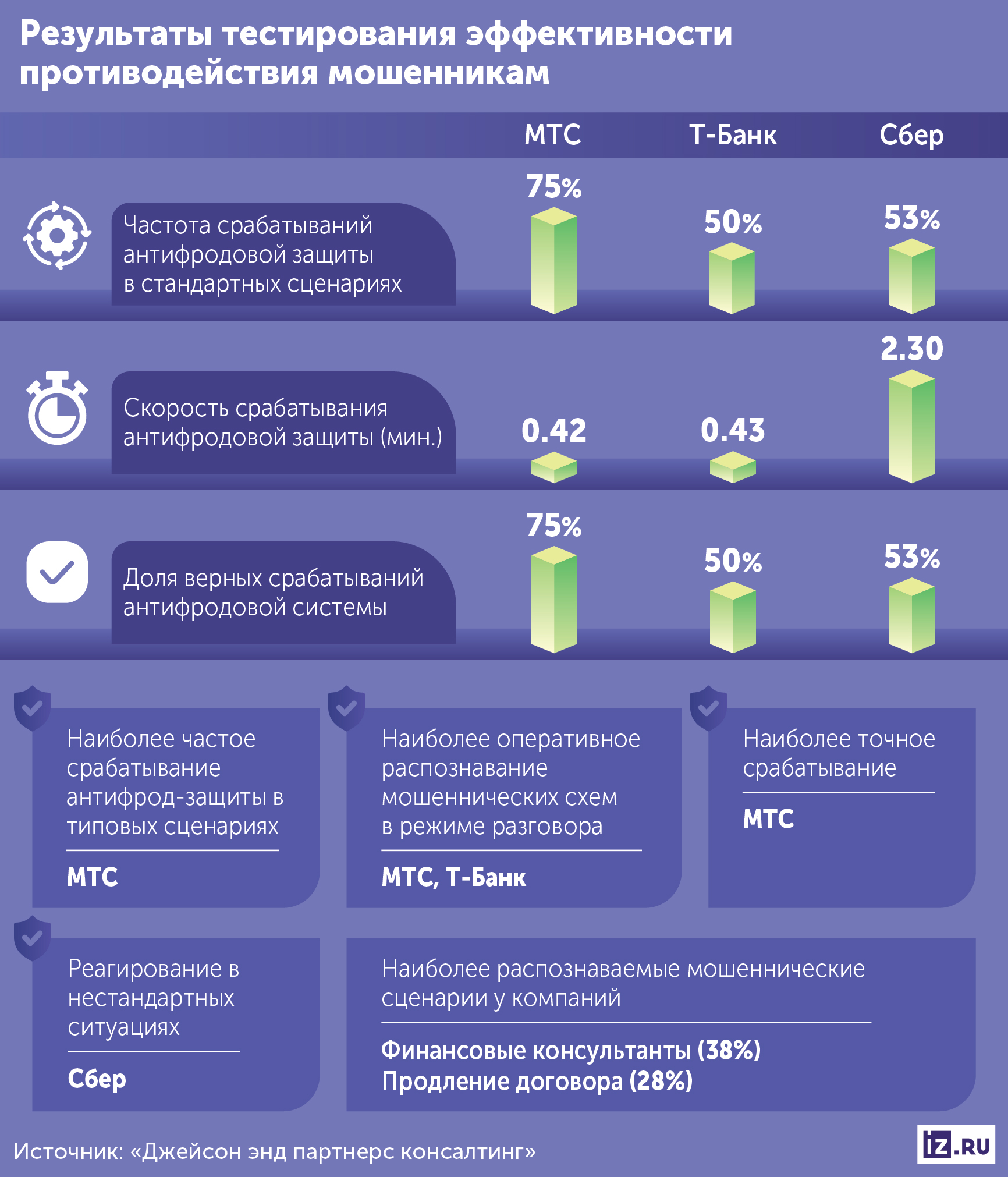

As part of the study, J'son & Partners Consulting also tested the security systems that companies use to protect their clients from fraudulent attacks. According to the results of testing the effectiveness of anti-fraud services of telecom operators and ecosystems, the mechanism proposed by MTS turned out to be the most effective, J'son & Partners Consulting emphasizes separately. "MTS is the leader in the effectiveness of anti—fraud protection (the most frequent protection for fraudulent calls and the lowest proportion of false alarms)," the study says. The system recognizes fraudulent schemes most quickly in conversation mode — it takes about 42 seconds on average, the authors of the study estimated.

In standard scenarios, MTS protection is triggered in 75% of cases, and the proportion of correct system responses is also 75%, according to J'son & Partners Consulting. At the same time, according to the company in its report, the Yandex and Kaspersky services did not recognize the fraud schemes during the conversation and did not work, and the development of a number of mobile operators was able to detect "a small number of calls."

The highest efficiency of MTS anti-fraud systems was achieved thanks to the "Secure Call" function. This mechanism provides instant notification of the subscriber about the conversation with the scammer right during the call. In the Android operating system, for example, the MTS system is triggered by issuing a beep and a voice message: "Attention, you may be talking to a scammer," after which the conversation continues, but the scammer does not hear the notification. On iOS devices, the notification is accompanied by an interruption of communication. This feature allows the subscriber to make a decision on their own and stop fraud, which ensures not only a high frequency of correct responses, but also a minimal proportion of false ones, according to one of the participants in the digital market.

In addition to anti-fraud services, companies are actively developing other areas of digital security. Sber remains the most active player in the category of financial and personal data protection, offering, for example, the Credit History Monitoring service, according to a report by J'son & Partners Consulting. MTS, Sberbank, T-Bank and Beeline also provide fraud and refund insurance, and this is already becoming a trend.

What is the effectiveness of an integrated approach to fraud

MTS' success is largely due to the work of its key anti-spam and anti-fraud service, dubbed Defender. It has been available to the company's customers since 2024, experts say. This set of functions allows you to protect subscribers both proactively and already at the moment of communication, says Denis Kuskov, CEO of TelecomDaily.

— Now that fraudulent schemes are becoming more frequent and diverse, countering them is necessary. All companies are modernizing their security systems, but MTS' leadership position is provided by advanced technologies and innovative approaches, which are reflected, among other things, in the Defender. He protects the client constantly: even before the implementation of fraudulent schemes and after the scammers have already established contact with the user, — Denis Kuskov notes. According to him, the Defender is now one of the best solutions on the market. It allows users to feel protected, the expert believes.

The Defender checks incoming calls against an extensive database and, if the number is considered undesirable, for example, fraudulent, answers the call instead of the subscriber, protecting him from unnecessary communication, follows from the description of the platform. After the call is completed, the subscriber receives a notification (for example, via SMS or through the My MTS application) and a transcript of the conversation in text format. In addition, the service provides a "Caller ID" function, which shows on the call screen the caller's reliability level and, in the case of a call from an organization, its name and category, classifying them, for example, as "fraudster" or "spam call".

The extended option — "Defender+" — includes the "Safe Call" function. Its essence is that the algorithm analyzes the conversation in real time. If the system detects signs of communication with a fraudster, the subscriber receives a loud warning sound directly into the voice channel of the call, allowing them to immediately interrupt communication. The service also helps to determine whether a user's personal data has been compromised as a result of leaks from credit institutions, online stores and other sources, and provides recommendations for their protection, as well as offers fraud insurance up to 1.5 million rubles.

By their very nature, various filters and protection systems somewhat contradict the original purpose of ecosystems — fast and barrier-free access to communications, financial and other services, but in the current situation they cannot be dispensed with, says Sergey Vilyanov, an analyst at the Fintech Club accelerator. Protection against threats must be built over the years: even after investing a lot of money, it cannot be provided all at once, the expert notes.

By the way, scammers of all stripes have always hated and continue to hate companies that use a systematic approach to ensuring information security, the analyst concludes. And the dislike of cybercriminals here is inversely proportional to the trust of users.

Переведено сервисом «Яндекс Переводчик»