Farmer's feeling: The European Union has sharply reduced the purchase of fertilizers from Russia

- Статьи

- World

- Farmer's feeling: The European Union has sharply reduced the purchase of fertilizers from Russia

Europe is voluntarily tightening its belts without Russian fertilizers, but the cost of these savings may be too high for local farmers. The volume of purchases of these products by the European Union in the second half of 2025 fell by about 70% compared to the first. As the Russian permanent mission to the EU told Izvestia, such a sharp collapse was the result of the introduction of protective duties by Brussels. At the same time, the sanctions policy has already hit farmers.: the cost of nitrogen fertilizers in Germany increased by 10%. In the future, the pressure on European agriculture will only increase due to competition with the Latin American MERCOSUR bloc and the launch of a new CBAM environmental tax.

The EU has reduced the purchase of Russian fertilizers

The EU increased duties on Russian fertilizers last year. The main goal is to reduce dependence on trade with the Russian Federation. Since the middle of 2025, in addition to the base ad valorem rate (calculated as a percentage of the cost) of 6.5%, specific rates of €40 per 1 ton for nitrogen fertilizers and €45 per 1 ton for complex fertilizers have been added.

— Starting from July 2025, there has been a significant reduction in imports of Russian fertilizers. It should be noted that their share in the total volume of fertilizer supplies to the EU has increased from 22% to 24% since the beginning of 2022, as of September 2025, the Russian permanent Mission to the EU told Izvestia.

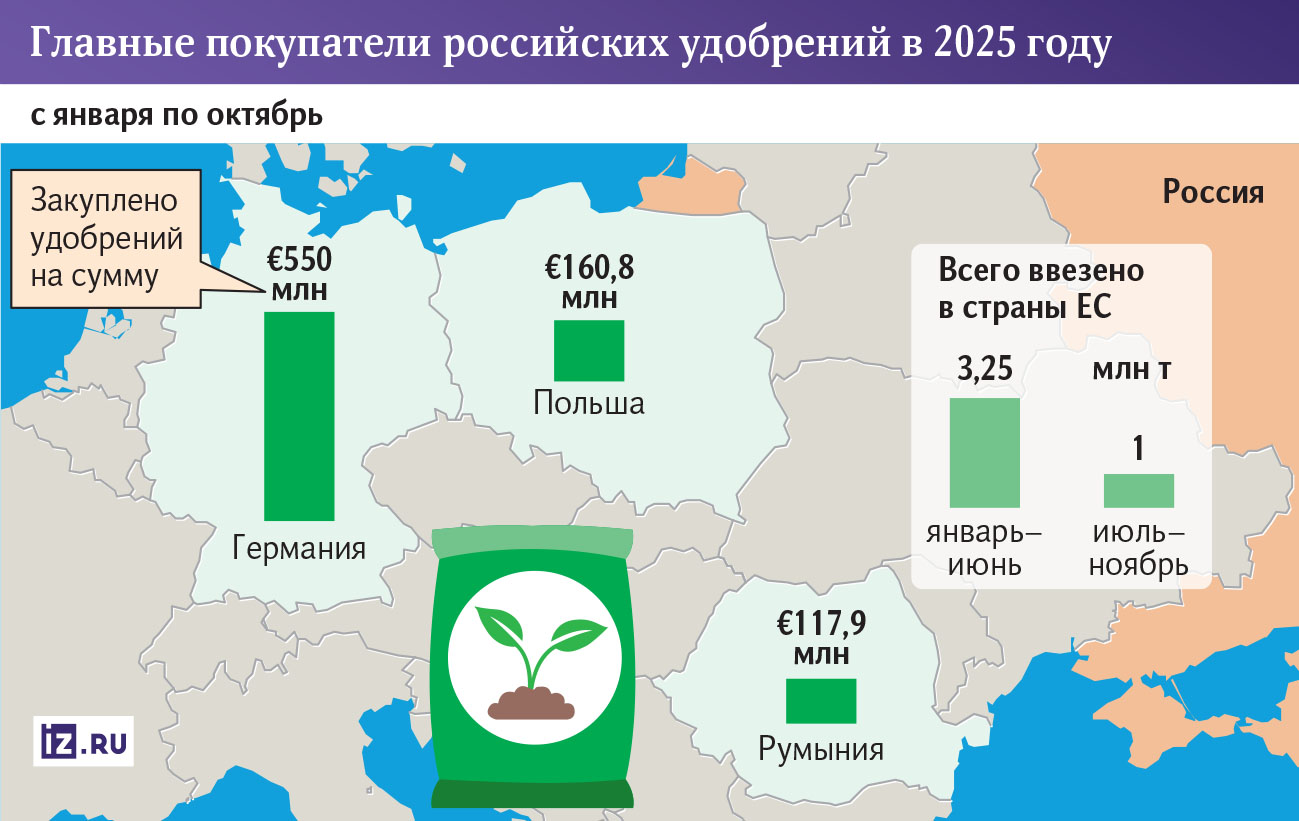

This trend is explained by the increase in fertilizer supplies by EU importers in the first half of 2025 in order to form reserves, the permanent mission noted. In total, according to Eurostat, in the first nine months of 2025, imports of all types of Russian fertilizers to the EU amounted to €1.34 billion. About 3.25 million tons were imported in January–June, and June 2025 was the record month since the beginning of 2022: 0.91 million tons worth €331.5 million were imported.

In the second half of the year, the situation changed: imports fell by 70% in physical volume and by 75% in value, to about 1 million tons worth €281 million excluding data for December, Izvestia estimated. According to the same Eurostat, in January – November 2025, importers paid €1.523 billion for fertilizers, and almost the same amount was for the same period in 2024.

Poland has become the main buyer of Russian fertilizers. From January to October, she bought 550 million euros worth of them. It is followed by Germany (€160.8 million) and Romania (€117.9 million).

Before the restrictions were introduced, the positions of Russian suppliers remained stable due to the internal crisis in Europe. The abandonment of Russian energy sources in 2022-2023 led to the closure of a number of chemical enterprises, in particular, for the production of nitrogen fertilizers, the permanent mission of the Russian Federation emphasized. Against the background of limited supply, Russian products, as more competitive, were in high demand on the European market.

EU measures hit farmers

Now this stability is coming to an end. The Association of European Farmers and Agricultural Cooperatives Copa-Cogeca believes that restrictions on fertilizers from Russia will seriously affect the agro-industrial complex and the competitiveness of producers in Europe.

Farmers are concerned that the shortage of fertilizers in the EU market as a result of the increase in duties will not be compensated by an increase in their supply, including through domestic production, at affordable prices. According to the association's calculations, the restrictions will lead to an increase in fertilizer prices in the EU by at least €40-45 per 1 ton in the agricultural season of 2025-2026.

— This increase, as a result, will push up food prices for the final European consumer. Thus, the European bureaucracy continues to ignore the interests of farmers and ordinary Europeans," the Russian permanent mission noted.

However, so far European farmers have managed to stay afloat. Dirk Heubers, general director of an agricultural enterprise in the north of Brandenburg, told Izvestia that fertilizer prices have not increased much. At the same time, he clarified that contracts for their supply were concluded even before the introduction of duties, therefore, the company currently has no additional costs.

— Prices for potassium nitrate and other nitrogen-containing fertilizers have increased by about 10%. However, overall consumption continues to decline, as grain prices are now very low. This leads to the fact that farmers apply less fertilizers, and the demand for them decreases accordingly. First of all, it concerns nitrogen plants," he noted.

However, the situation risks becoming more complicated in the future. The rising cost of production due to expensive resources is only one part of the problem. European farmers see a much more serious threat in the liberalization of the market for external players.

On January 17, 2026, the EU signed an agreement with the MERCOSUR trade and economic bloc, which includes Argentina, Brazil, Paraguay and Uruguay. In this regard, farmers in France have taken tractors to the streets of Paris several times, opposing the signing of the deal. Their colleagues from Ireland did the same, and in December 2025, mass protests took place in Brussels. The key motive is the fear that the EU market will open up to cheaper agricultural products from MERCOSUR countries. According to opponents of the agreement, Latin American farmers are in less strict conditions, which reduces the cost of their products, which, in turn, will "bring down" prices and margins of European farms already in Europe.

— More and more requirements and standards are being imposed on farmers who do not have such power or are not widely recognized in other regions of the world. This leads to the fact that the competitiveness of European farmers is actually being lost," Austrian geopolitical analyst Patrick Poppel told Izvestia.

In addition to trade agreements and duties, the environmental agenda of Brussels is becoming an additional burden for the agricultural sector. Since January 1, 2026, the so—called CBAM (EU Carbon Border Mechanism), an EU instrument that imposes a tax on imports of high-carbon-intensive goods, has been fully operational. Now it also applies to fertilizers.

Under the new system, farmers need to report how much CO₂ was emitted during production and pay for these emissions. Additional fees make imports more expensive — companies include these costs in the final cost of the goods. France and Italy even sent initiatives to Brussels asking them to temporarily postpone CBAM for fertilizers, but this did not work.

EU institutions already recognize that there is a direct risk of higher prices for farmers. The final document of the meeting of the Ministers of agriculture of the association dated January 7 explicitly states that fertilizer prices have stabilized, but remain about 60% higher than in 2020. According to the I4CE analytical center, the costs of introducing SWAM will manifest themselves as the taxation mechanism is fully deployed.

Переведено сервисом «Яндекс Переводчик»