To take the damage: losses of unprofitable banks have tripled in a year

The financial losses of unprofitable banks have tripled over the year — in August they reached 230 billion rubles, according to the Central Bank (Izvestia has it). According to the results of the first half of the year, for example, the Post Bank and Renaissance Bank were in the red. The main reason is the maturation of problem loans, for which market participants have to allocate more and more reserves. The decrease in the key rate and the revaluation of floating-rate loans also had an impact. Whether there are risks to the banking system is in the Izvestia article.

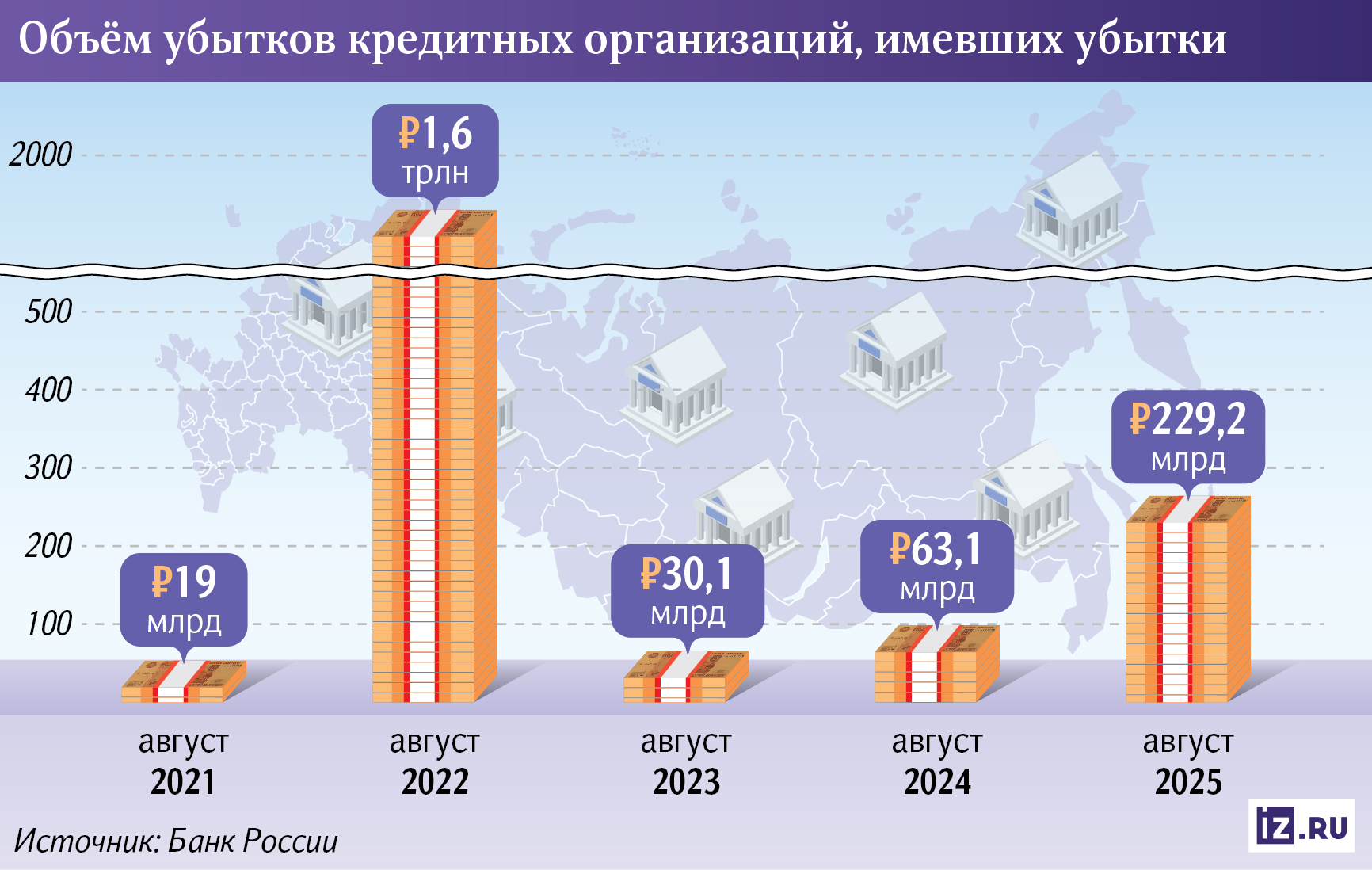

How much have creditors' losses increased

The volume of losses of unprofitable banks in August approached 230 billion rubles, which is 3.6 times more than a year earlier, according to the regulator. Losses of financial institutions could grow against the background of an increase in the share of problem debt and revaluation of loans with a floating rate after lowering the key rate to 17%, experts said.

The net profit of the sector in August decreased by almost half compared to July — after 397 billion rubles, it fell to 203 billion rubles, according to the Central Bank. In the materials of the Bank of Russia for August, it is noted that the number of unprofitable banks increased by 13 and reached 68 (out of 306). This was facilitated by an increase in deductions to reserves (by 67 billion rubles), a decrease in net interest income by 36 billion rubles. It also includes a 16—fold reduction in dividends from subsidiaries to 4 billion rubles and an increase in tax payments by 33 billion rubles.

The main reason is the growth of reserves for problem loans, said Yaroslav Kabakov, Director of Strategy at Finam IC. According to him, banks quickly formed additional deductions, as the quality of assets deteriorated in both the corporate and retail segments. At the same time, money is now expensive for players — deposit rates have been in the range of 18-20% for most of the year, according to calculations by Izvestia.

The volume of overdue consumer loans has reached 1.5 trillion rubles. This is a record for the last six years, according to the Central Bank's data, which was studied by Izvestia. The Bank of Russia clarified that the volume of problem debts increased by 400 billion rubles by May compared to the same period last year, their share reached 5.7% of the retail portfolio.

— The increase in overdue and restructured loans was the result of a slowdown in the economy, a decrease in household incomes and an increase in the debt burden, — concluded Yaroslav Kabakov.

Loans issued in late 2023 and early 2024 at high interest rates to risky borrowers are overdue, the Central Bank's press service said. Problem loans are 90% covered by reserves, which means that banks have set aside money in advance in case they are not repaid. Restrictions on loans to borrowers with a high debt burden are already contributing to improving the quality of the loan portfolio.

Loan servicing has deteriorated sharply in the market, said Mikhail Aleksin, General Director of the United Credit Bureau (OKB). According to him, the risk accumulated throughout 2024, and the peak of delinquencies and defaults occurred in the first half of 2025.

Due to this, the losses of unprofitable banks in August 2025 exceeded the figures of recent years. The figures were higher only in the crisis year of 2022, when market participants had to make large reserves. Back in August, losses reached 1.6 trillion rubles, and credit institutions still coped with this shock.

In general, the total profit of banks now amounts to an impressive 2.4 trillion rubles, according to the Central Bank. This figure is ten times higher than the losses of unprofitable banks, which means that the sector as a whole is in the black.

How does the key rate affect the income of banks

—In the reporting for 2025, losses were recorded not only by small regional banks, but also by individual large players, who are usually considered stable,— said Yaroslav Kabakov from Finam.

For example, according to open reports on RAS, Postbank increased its net loss to 7.6 billion rubles in seven months, while Renaissance Credit's loss increased 4.1 times over the same period compared to last year, to 0.57 billion rubles, said Vladimir Chernov, analyst at Freedom Finance Global. The reasons are typical: high cost of risk and expensive passive base.

There is a key influence factor that makes bank deposits expensive, Yaroslav Kabakov noted. When the rate is lowered, the effect on profitability is delayed: old deposits are still in circulation, and loan income is adjusted only after some time, when the base of new cheaper deposits has accumulated.

In addition, the high key interest rate contributes to a slowdown in lending, said Oleg Abelev, head of the analytical department at the investment company Rikom-Trust. The real loan rates still exceed 30% in the largest banks. The high cost of borrowing already reduces the demand for loans.

In addition, the players themselves are becoming more attentive to who they are giving such expensive money to — the share of loan approvals in July was around 20%. This means that banks reject four out of five loan applications.

— As a result, expensive liabilities and weak credit growth squeeze the interest margin, and the deterioration in asset quality requires additional reserves, increasing losses even with a rate cut, — said Yaroslav Kabakov.

First of all, the growth of problems in the market affects the cost of banking services. In such circumstances, credit institutions tend to reduce loan rates less actively, while deposit yields are overestimated almost immediately after a key rate change. This is due to the desire of banks to maintain their profitability, Finam clarified.

Nevertheless, there are no risks to the stability of the system now, said Eduard Rumyantsev, partner of the audit and consulting group Unicon. However, the sector's profits will still decrease. According to the base forecast, the Central Bank expects it to reach 3-3.5 trillion rubles in 2025. For comparison, the market closed last year with a record profit of over 4 trillion rubles.

The situation may stabilize in the medium term. This will happen due to a slowdown in the growth of overdue payments, the adaptation of borrowers to new interest rates and the economic recovery, Finam concluded. But if problem loans continue to grow, banks' losses will persist.

Переведено сервисом «Яндекс Переводчик»