Resident regiment: the number of firms in "Russian offshore" has grown 1.5 times

Thenumber of companies in "Russian offshore centers" has grown 1.5 times in 2024 - now there are almost 500 residents, Izvestia has found out. Among them are major players such as Yandex, HeadHunter, Mother and Child. Organizations that were previously registered in foreign jurisdictions and faced problems due to sanctions move there first of all. In special administrative districts (SARs) they have been given easier conditions for doing business. However, in the future "Russian offshore" may become a center of attraction for foreign investments as well. What companies are planning to move to Russia in 2025 - in the material of "Izvestia".

How special administrative districts work in the Russian Federation

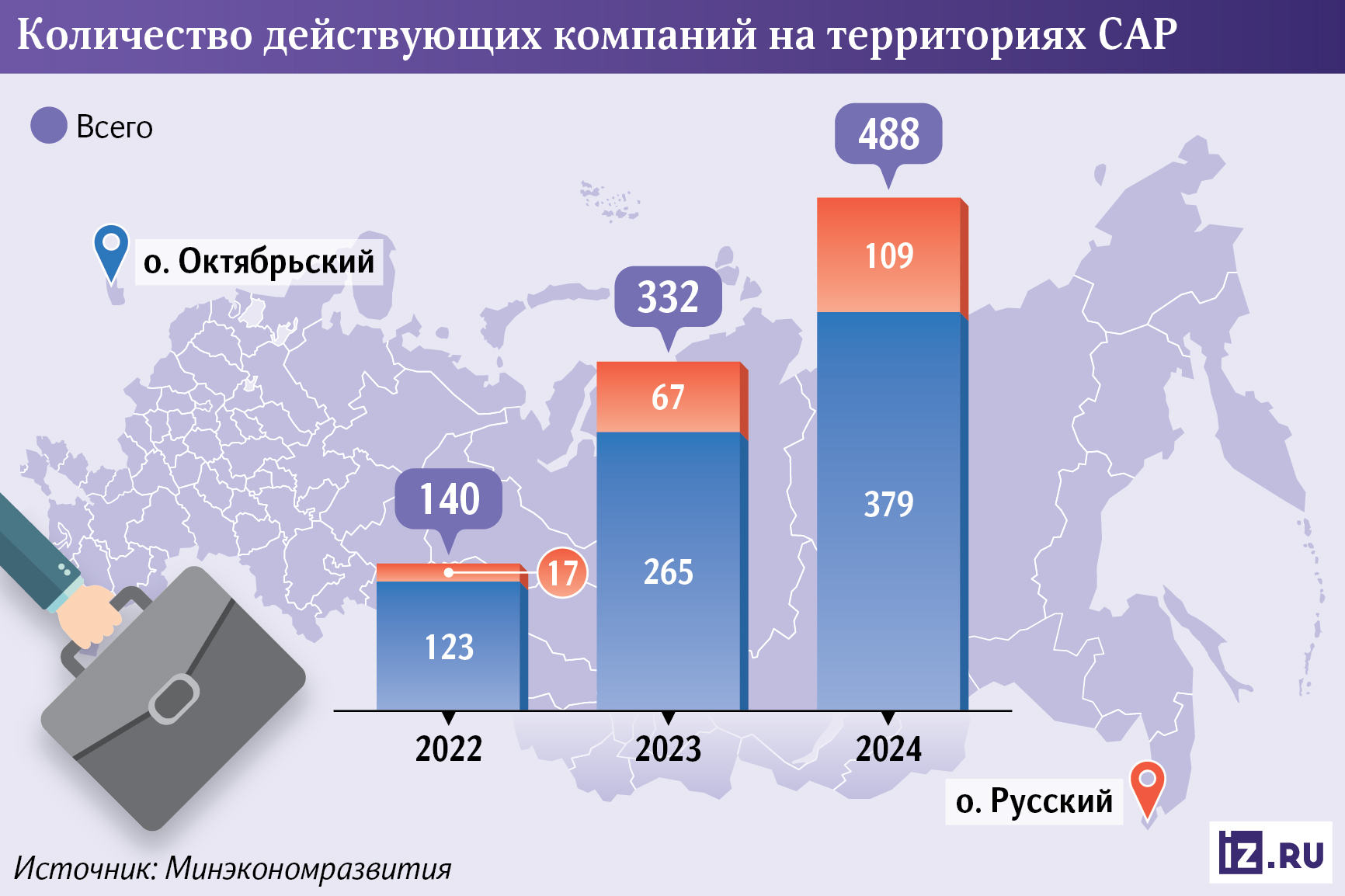

At the end of 2024 in SARs registered 488 companies, of which 379 residents - on the island of Oktyabrsky (Kaliningrad region) and 109 - on the island of Russky (Primorsky Krai), told "Izvestia" in the press service of the Ministry of Economic Development. In just one year, 190 participants moved to "Russian offshore" from foreign jurisdictions, and their total number increased almost 1.5 times.

Special administrative districts are territories with a simplified regime of tax and currency regulation. It is suitable for companies that have decided to transfer from a foreign jurisdiction to a Russian one. ATSs appeared in the Russian Federation in 2018. Their main purpose was to deoffshorize foreign holdings controlled by Russian citizens.

The number of firms in "Russian offshore" began to grow sharply in 2022, after the introduction of anti-Russian sanctions. Before that, residents appeared there slowly - in 2019 there were 22. As specified to "Izvestia" in the Ministry of Economic Development, in 2022 in these zones registered 83 new participants, and in 2023 - 200 organizations at once.

At the same time, some companies registered in ATSs could move from them to other constituent entities of the Russian Federation over time.

In 2024, such large companies as the recruiter HeadHunter and the medical center "Mother and Child" moved to SARs from Cyprus. In addition, in February 2024, Yandex completed re-registration in the Russian jurisdiction from the Netherlands, said Freedom Finance Global analyst Vladimir Chernov.

In "Russian offshore" there are large firms from various industries, in particular from the energy sector, agro-industrial complex, development, and services. However, the Russian SME sector is also actively moving to such areas, Alexander Isaevich, CEO of the SME Corporation, told Izvestia. Many small businesses are registered on Oktyabrsky and Russky Islands, employing more than 1.6 thousand people.

The full list of organizations that are registered in the ATSs is not in the public domain. Most likely, companies with Russian beneficiaries, rather than foreign ones, are mostly operating there, said Alexei Tarapovsky, founder of Anderida Financial Group.

Tax regime in ATSs

Under sanctions pressure from the EU and the US, it has become dangerous for Russian companies registered in unfriendly states to stay there, explained Svetlana Tikhonova, counselor at NSV Consulting law firm. That is why the state has introduced a simplified procedure for their relocation (so-called redomiciliation) to ATS since March 2022. This measure was recently extended until the end of 2025, added international and tax law attorney Pavel Martynchenko.

- The activities of most companies were literally blocked - foreign banks closed their accounts, and foreign lawyers and auditors, obeying the new sanctions legislation, refused to provide services to such firms,- said Svetlana Tikhonova.

According to the expert, the move to ATS was the only way to restore operations after the firm was blocked, in fact - a rescue with the preservation of assets.

When registering in "Russian offshore" companies receive tax advantages and reduce the cost of doing business, specified in "Tsifra Broker". For example, when moving to ATS companies receive a reduction in income tax by up to 5% on income received and up to 10% on dividends, interest and royalties paid by international companies.

Also, transportation and property taxes are not paid in ATSs, and there is no currency control in these zones. Organizations there will be able to use foreign corporate law until 2039 (that is, they can operate under the rules adopted in another state - where they were originally registered).

Thechange of jurisdiction also allows public companies to return to the payment of dividends to shareholders, analysts of FG Finam reminded.

- The conditions for moving companies to special administrative districts are constantly improving. The Ministry of Economic Development continues to respond to business requests and create useful tools that will make the ATS regime more attractive," Deputy Prime Minister Alexander Novak told Izvestia.

At the same time, work continues to improve the institution of personal funds in ATSs. To increase the availability of their use, the minimum amount of contributed property to the fund was reduced to 500 million from 5 billion rubles, emphasized Kirill Baranov, a member of the Council of the Chamber of Commerce and Industry of the Russian Federation on Financial-Industrial and Investment Policy.

Which companies will move to Russia in 2025?

The process of relocation continues. In 2025, marketplace Ozon and real estate aggregator Cian should complete redomiciliation in Russia, said Vladimir Chernov from Freedom Finance Global. These companies are already registered in ATSs, but the move is considered complete only after they stop working in the previous jurisdiction through liquidation of the old legal entity. Real estate developer Etalon is also planning to re-register, Tsifra Broker said.

- However, the number of companies that remained to work in unfriendly jurisdictions is systematically decreasing, so the demand for redomiciliation to Russia in 2025 in absolute figures will decrease, - emphasized Vladimir Chernov.

Nevertheless, ATSs will retain their importance for the Russian economy, Finam noted. The main thing is that "Russian offshore" will ensure trouble-free operation of companies located there during a difficult foreign policy situation. In addition, they will support the inflow of tax revenues and help create new jobs.

In the next 5-10 years "Russian offshore" will contribute to the development of innovative industries - fintech, blockchain, artificial intelligence and biotechnology, believes Vladimir Chernov. The creation of special economic zones will help Russia reduce its dependence on traditional industries, such as energy, and move to a more diversified economy.

In addition, SARs play the role of an "economic harbor" for companies, providing them with favorable conditions for business, concluded Kirill Klimentiev from Tsifra Broker. In the future, they may become centers for attracting investments from abroad and help integrate the Russian economy with partners from BRICS, Asia and the Middle East.