- Статьи

- Economy

- In the dark and in offense: why scammers revived the scheme of deception "transfer by mistake"

In the dark and in offense: why scammers revived the scheme of deception "transfer by mistake"

In 2024, fraudsters have become 20% more likely to darkly involve good citizens in their activities, including dropshipping, Yevgeniya Lazareva, coordinator of the Moshelovka platform, told Izvestia. This is a consequence of the government's new strict measures to counter fraudulent bank transfers. The most common is the seemingly forgotten scheme of "transfer by mistake". As a result, unwitting accomplices of fraudsters are included in the Central Bank's black database as droppers and are deprived of remote banking services. How criminal schemes work and what to do if the swindlers still used you in the dark - in the material "Izvestia".

What kind of people become unwitting accomplices of swindlers

Fraudsters have intensified the use of schemes in which they darkly involve in their activities unsuspecting good citizens. This was reported to "Izvestia" by the coordinator of the platform "Moshelovka" Evgenia Lazareva with reference to the statistics of citizens' appeals. According to her, for the incomplete year 2024, the number of reports of such incidents has increased by almost 20%.

Experts attribute this trend to the fact that the government has recently tightened measures to counteract fraudulent bank transfers. In particular, the law came into force on July 25, 2024, which obliges banks to suspend suspicious transfers and transfer the data of compromised accounts to the Central Bank's database.

After that, credit organizations began to treat each transaction very carefully. As a result, the demand for so-called drops - people whose bank accounts are used to withdraw fraudulently stolen funds - has grown significantly, said Evgenia Lazareva. She explained that the lifespan of the card of willing or unwilling assistants of swindlers has been reduced from a couple of weeks to two days.

- The resonance around the new law was so strong that it became more difficult for attackers to find voluntary drops. Therefore, scammers had to find new ways of withdrawing the funds of deceived citizens into their pockets. First of all, they began to use schemes for blindly involving good citizens more often," the expert said.

The Central Bank press office also noted that in addition to more or less conscious participation in dropshipping (when people try to make money from it), there are cases when citizens do not even know that they are involved in illegal activities.

In the appeals of citizens to "Moshelovka" there are now three main schemes, said Evgenia Lazareva.

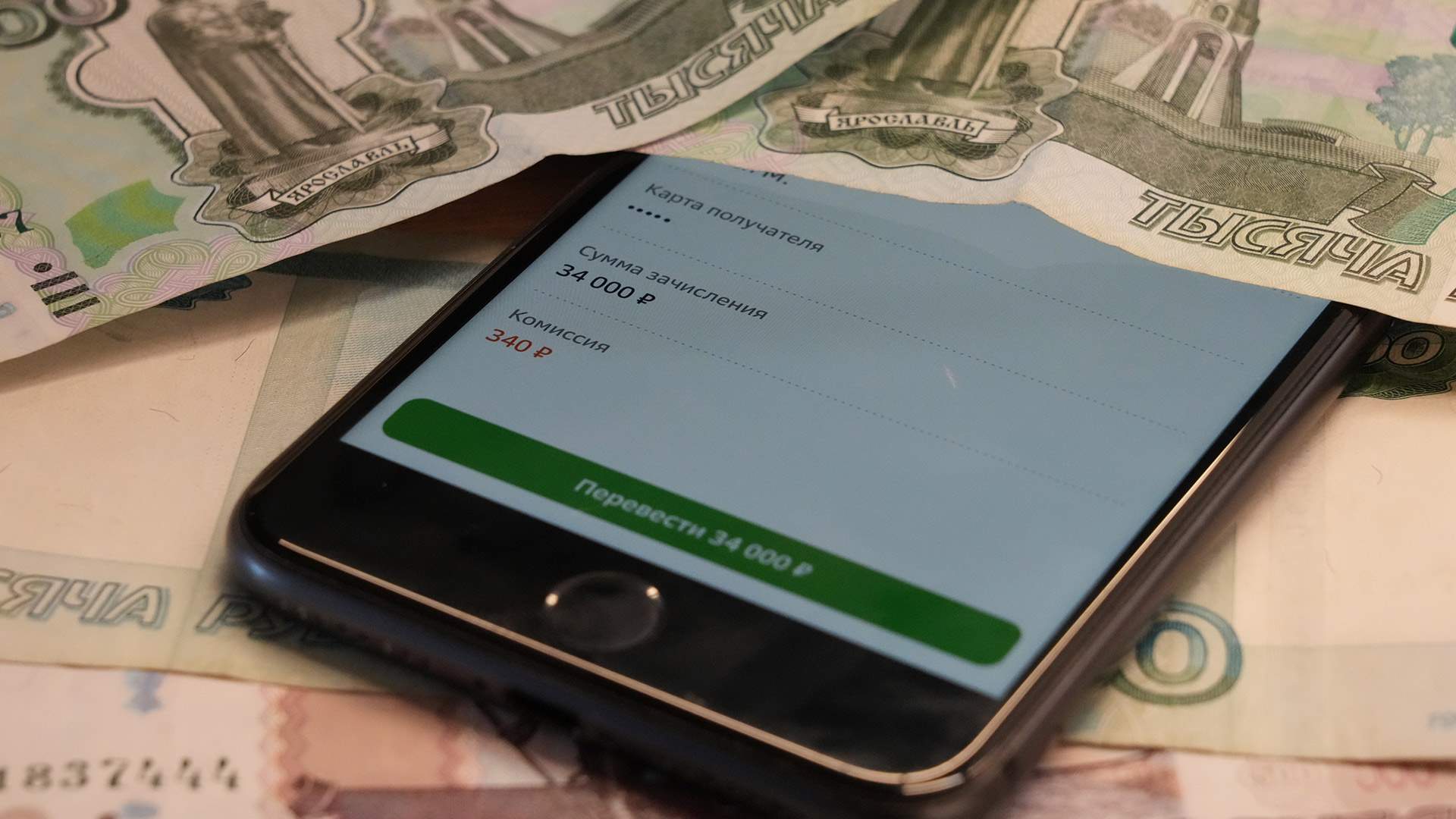

The first one was considered forgotten, but recently it has become widespread again - "erroneous transfer". A significant amount of money falls on the victim's card. Then comes a call from an unknown number with assurances that there has been a mistake and requests to return the money, but to another card. If the victim declares that she will keep the money, she is intimidated into contacting the police about unlawful enrichment. And people usually agree to return the money.

- Thus, the victim at the moment of transferring the money to another account becomes a drop, without realizing it and acting with the best of intentions, - explained the curator of "Moshelovka".

But the case does not end there. The unwitting accomplice of the con artists receives a call from a victim - the person who transferred money for some goods (most often expensive: the calls include laptops, plasmas, fitness equipment, motor boats, etc.), but did not receive his purchase. The two victims find out the relationship, feeling that they are right. As a result, the failed buyer turns to law enforcement agencies, and the unwitting drop gets into the database of the Central Bank with all the consequences - disconnection from remote banking, etc.

The second scheme is hacking. Under the influence of social engineering or with the help of malicious software, attackers gain access to a person's personal account in the bank. And until the victim restores access (this can take from several hours to several days), not only withdraw all available funds, but also try to transfer money from other victims through their accounts. Naturally, such uncharacteristic activity comes under suspicion of the security service of the credit organization. The bank blocks the account and sends information about it to the Central Bank's database.

- It is quite understandable that arguments about hacking may not convince the bank and the regulator, and the victim is punished not only with a ruble, but also with the absence of remote service," said Evgenia Lazareva.

The third scheme - issuance of cards and loans using forged or stolen documents of the victim. The consequences are similar to other cases of involving citizens in unwitting complicity with fraudsters.

- Unfortunately, unfortunately, any victim of social engineering can become a passive dropper willy-nilly," emphasized Evgenia Lazareva.

The Central Bank's press service told Izvestia about the existence of another scheme. Attackers offer citizens who have previously suffered from the actions of fraudsters, allegedly cooperating with law enforcement agencies to fight crime, promising them a monthly income.

- In fact, in this way bank customers were used as dropships. That is, the fraudsters transferred stolen money to their bank card and forced them to follow further instructions to "save" funds, and in fact - to illegally cash in other people's money," the Central Bank explained.

Why the chances of being blacklisted by the Central Bank are increasing

"Izvestia" has already written about the fact that the number of complaints to the Central Bank from Russians who are actually disconnected from banking services because they get into its database of suspicious transactions and accounts, has risen sharply. Experts confirm that many may indeed be mistakenly affected due to the fact that the use of fraudulent schemes to engage citizens in darkness has increased.

- There are many variations of when a person becomes a dropoff willy-nilly. The mistaken transfer scheme is also used quite often. In order not to be blacklisted by the Central Bank, it is necessary to be extremely careful with transfers to people you don't know," said Daria Verestnikova, Commercial Director of SafeTech.

The new rules are such that a bank can legally apply restrictive measures even to a bona fide citizen who has actually been set up by fraudsters, including by the methods described, agrees Roman Bubnov, a lawyer at Zabeida & Partners.

- This is facilitated by one of the new signs of suspicious transaction - the receipt of information to the bank about signs of fraud, as well as atypical parameters of calls and messages to the client on the eve or at the time of the transaction, - he explained.

Unfortunately, the lawyer clarified, the existing mechanism of countering remote fraudsters and dropships is such that the bank initially takes measures and only then starts proceedings.

What to do when fraudsters are involved in complicity

The press service of the Association for the Development of Financial Literacy (ARFG) advised: you should never transfer money received "by mistake". It is necessary to call the bank and report that an unknown transfer has arrived and describe the situation, they said.

- This way you can protect yourself from involvement in a fraudulent scheme and avoid the role of a dropper willy-nilly. And also show the credit organization your good faith, thus avoiding unnecessary restrictions for yourself," Roman Bubnov agrees. - Further actions should be taken taking into account the bank's recommendations.

The ARFG press service also recommends to contact the police immediately after a call to the credit organization.

- It is very important not to answer calls from unknown and unfamiliar numbers and messages from strangers in messenger after the transfer has been made," the association said.

On the one hand, this will show fraudsters that their attempts are futile, on the other hand, it will allow them to avoid the impact of social engineering.

When receiving an erroneous transfer, it is necessary to immediately contact the bank, report the incident and ask to return the money to the sender's details, advised the Central Bank.

If the victim has already made a transfer and then had doubts, the experts advise to contact the bank. According to Alexander Terentyev, a forensic expert of the Veta Expert Group, this will not affect the fact of not being included in the Central Bank's database, but it is necessary to take all the necessary steps to prove your innocence in the future: notify the bank about the erroneous operation, write a statement to the police about the fact of fraud, provide all the numbers from which the calls were made.

If a citizen has been undeservedly sanctioned by a bank, he can defend his right by appealing to the Central Bank, and if it refuses to lift the restrictions, he should go to court, Roman Bubnov said. The chances of proving your case increase if you provide the maximum amount of evidence, including copies of police verification materials about your own statement, your non-involvement in the actions of the attackers.

Переведено сервисом «Яндекс Переводчик»